Featured

Tqqq Inverse Etf

The Invesco QQQ is an exchange-traded fund ETF that is widely held and tracks the Nasdaq 100 Index. Leveraged and Inverse Broad Market ETFs.

Proshares Ultrapro And Ultrapro Short Etfs

Proshares Ultrapro And Ultrapro Short Etfs

The fund invests in financial instruments that ProShare Advisors believes in combination should produce daily returns consistent with the funds investment objective.

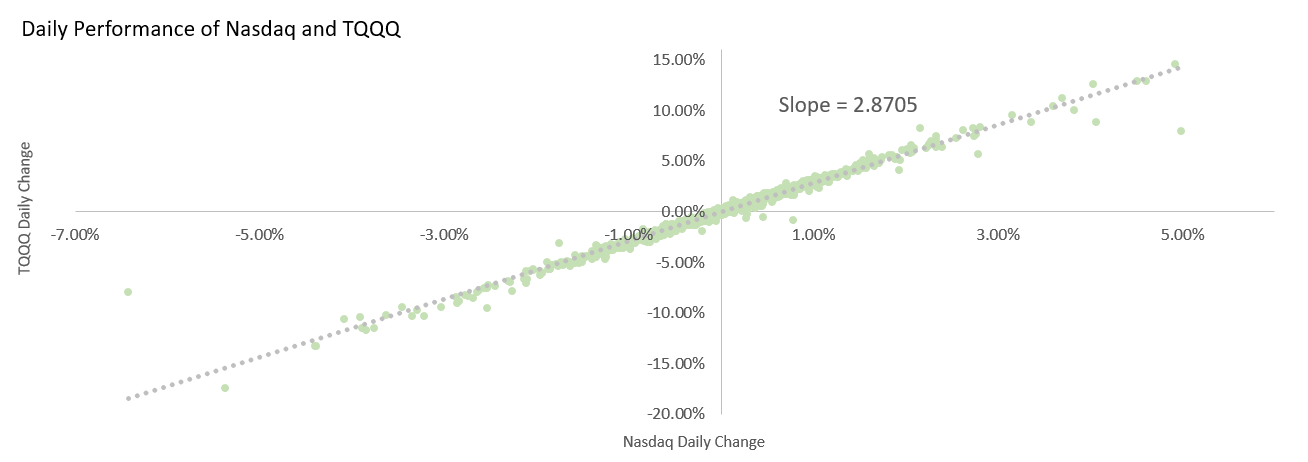

Tqqq inverse etf. ProShares leveraged and inverse broad market ETFs are cost-efficient tools to help investors take advantage of or defend against changing market conditions on a variety of US. Summing Up TQQQ. Its objective is to deliver a return that is 3 times the daily return of its target index the Nasdaq 100.

Hope this video gets you one step closer to your goal. Heres how TQQQ works. Companies in the technology health care.

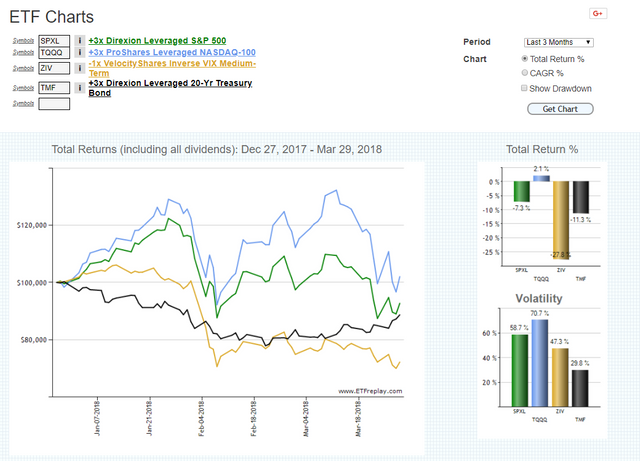

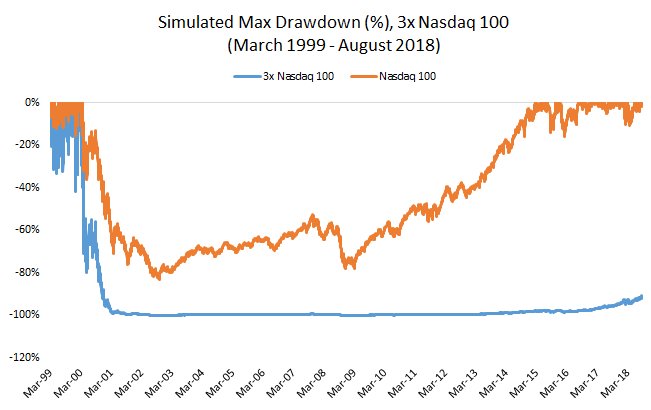

Those that would expect TQQQ to be up 87 3X 29 would be wrong due to the extreme leverage decay TQQQ faces. TRADING FLOOR CHAT with other Active Premium Members and our Stock Analyst. SIMPLE EASY TO FOLLOW TRADING STRATEGY We only trade two ETFs.

In other words if the underlying index falls by 1 SQQQ. Here is a beginner video on how to day trade inverse etfs in the stock market like tqqq and sqqq. Equity market through directional trades.

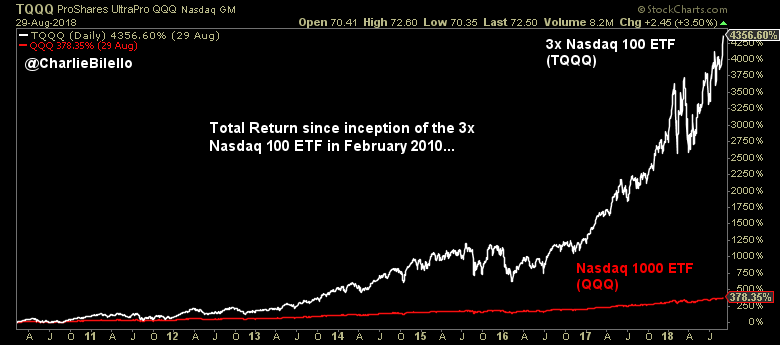

Risks of Leveraged Inverse Products. TQQQ is a levered fund that delivers 3x exposure only over a one-day holding period of NASDAQ-100 stocks. This means if the Nasdaq goes up by 1 today TQQQ should go up by 3.

TQQQ. On the other hand SQQQ is a leveraged inverse ETF and aims to provide three times the inverse of the Nasdaq 100 Indexs daily performance. QQQ is up 29.

This gives investors leveraged returns that exceed what index ETFs can offer. GROWTH CHALLENGE Our Members are Averaging 10 Monthly Returns. Established in February 2010 by ProShares the UltraPro Short QQQ SQQQ is an inverse-leveraged exchange-traded fund ETF that tracks the Nasdaq.

TQQQ is a 3X leveraged ETF. Seek profit from moves in the US. 27 rows ETF issuers who have ETFs with exposure to Inverse Equities are ranked on certain.

Its focus is on large international and US. The Direxion Moonshot Innovators ETF MOON provides exposure to an index which attempts to target 50 of the most innovative early-stage US-listed companies by identifying those pursuing innovation with the potential to disrupt their existing industries in future. Inverse ETPs seek to provide the opposite of the investment returns also daily of a given index or benchmark either in whole or by multiples.

If the Nasdaq 100 Index rises 1 TQQQ will generally rise 3 and vice versa. Experienced NDX traders who can judge trend and momentum can increase their profit quotient by shifting to TQQQ and its inverse ETF the ProShares UltraPro Short QQQ NASDAQSQQQ. Passive index-based passive index-based Dividend Yield.

Investors can use them to. Launched in September 2010 the fund seeks to deliver thrice 3x or 300 the inverse opposite return of the daily performance of the Nasdaq 100 Index before fees and expenses. TQQQ is up 45 on the year while the Nasdaq 100 ETF NASDAQ.

The investment seeks daily investment results before fees and expenses that correspond to three times 3x the daily performance of the NASDAQ-100 Index. REAL-TIME TRADE CALL-OUTS on our winning trading strategy mostly swing trades. Leveraged ETPs Exchanged Traded Products such a ETFs and ETNs seek to provide a multiple of the investment returns of a given index or benchmark on a daily basis.

So if the ETF is trading higher than the underlying price I believe that an AP can buy the underlyings on the open market and then exchange it directly through the ETF provider for the ETF to then sell for risk free money this naturally drives the price of ETFs down and the inverse happens to increase them. The underlying index includes 100 of.

How To Trade The Tech Sector With Leveraged Etfs Raging Bull

How To Trade The Tech Sector With Leveraged Etfs Raging Bull

Do All Leveraged Etfs Go To Zero Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Why Is Tqqq Or Spxl Or Leveraged Etfs A Bad Idea Quora

Proshares Ultrapro Qqq Tqqq Nasdaq 100 Inverse Etf 3x Vs Bull Etf Tqqq Youtube

Proshares Ultrapro Qqq Tqqq Nasdaq 100 Inverse Etf 3x Vs Bull Etf Tqqq Youtube

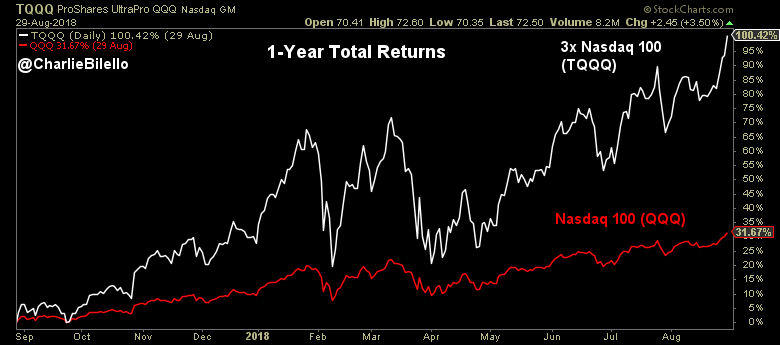

How To Buy And Hold Leveraged Etfs The Top 7 Outperforming 3x Etfs Over The Past Year Nysearca Uso Seeking Alpha

How To Buy And Hold Leveraged Etfs The Top 7 Outperforming 3x Etfs Over The Past Year Nysearca Uso Seeking Alpha

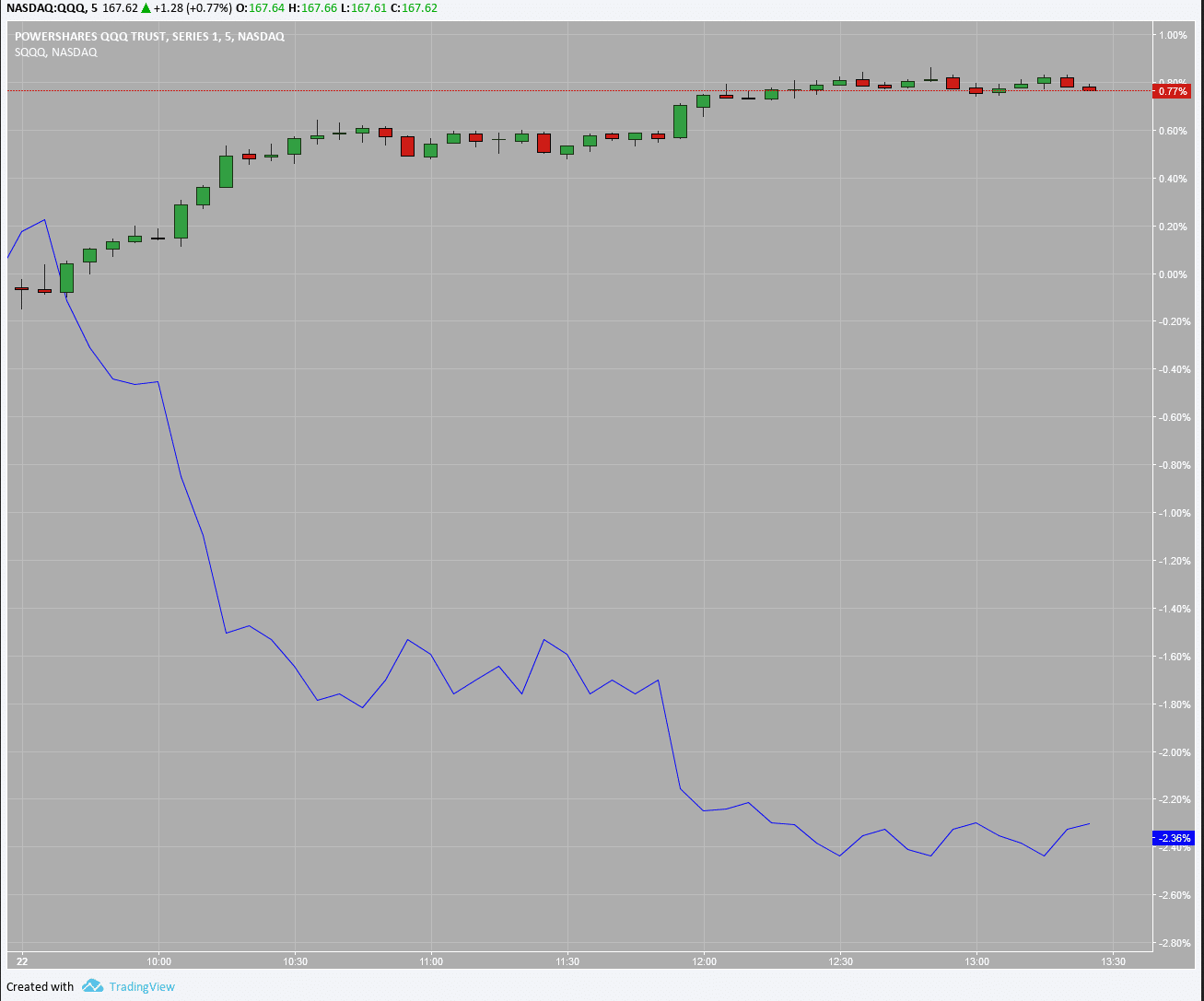

Triple Your Returns With Sqqq And Tqqq

Triple Your Returns With Sqqq And Tqqq

Aggressive Etf Portfolio Tqqq Maintains The Lead Steemit

Aggressive Etf Portfolio Tqqq Maintains The Lead Steemit

Tqqq Vs Tvix How Traders Are Playing Triple Leveraged Funds

Tqqq Vs Tvix How Traders Are Playing Triple Leveraged Funds

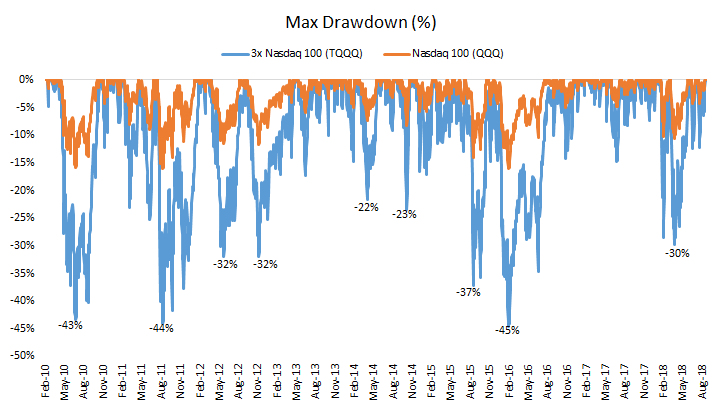

Do All Leveraged Etfs Go To Zero Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Inverse Leveraged Etfs In Charts Etf Com

Inverse Leveraged Etfs In Charts Etf Com

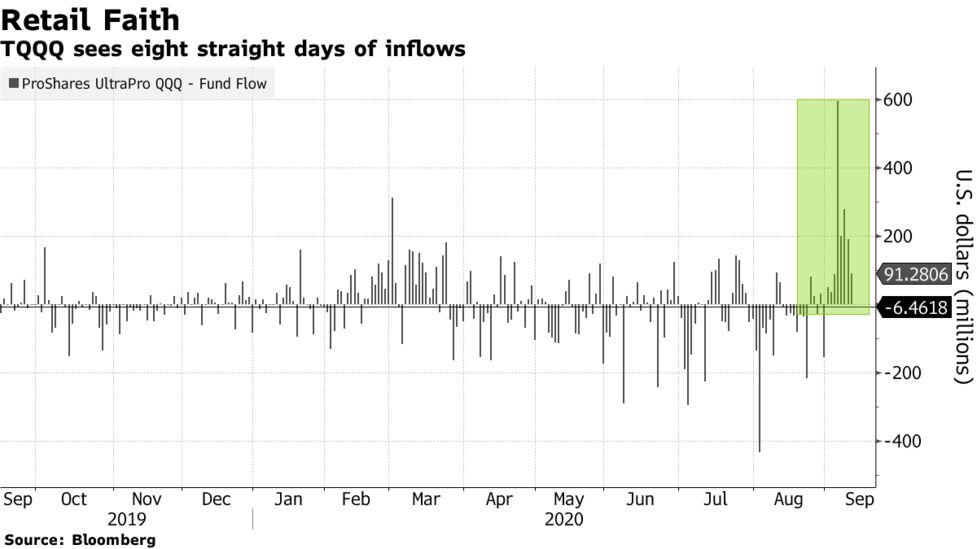

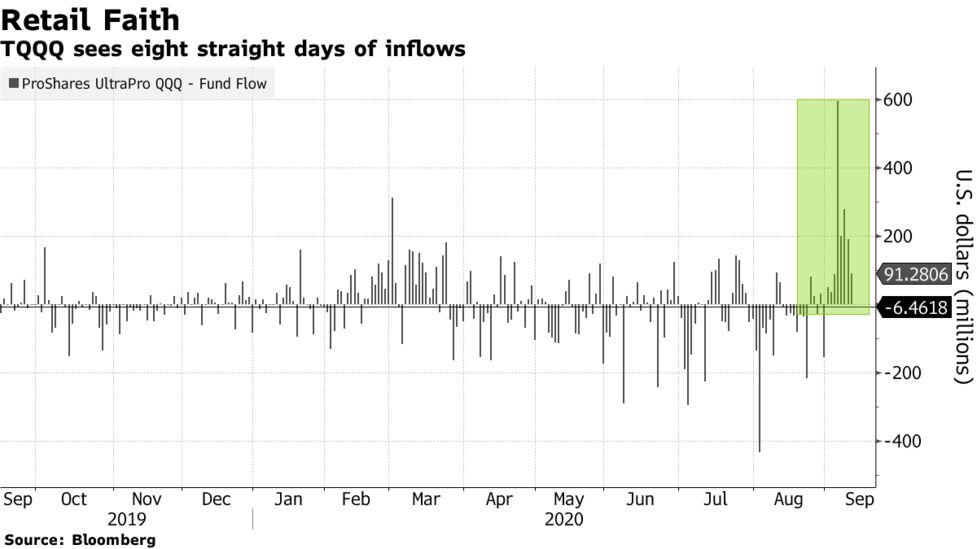

Triple Leveraged Nasdaq Etf Lures Record Cash Amid Retail Fervor Bloomberg

Triple Leveraged Nasdaq Etf Lures Record Cash Amid Retail Fervor Bloomberg

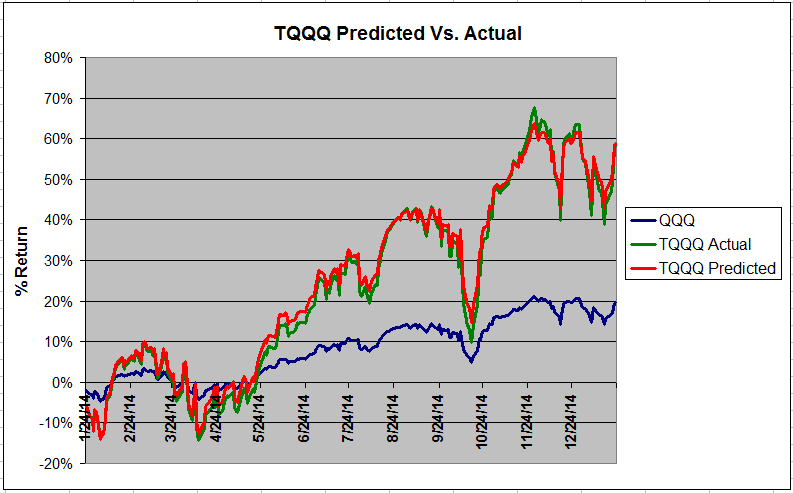

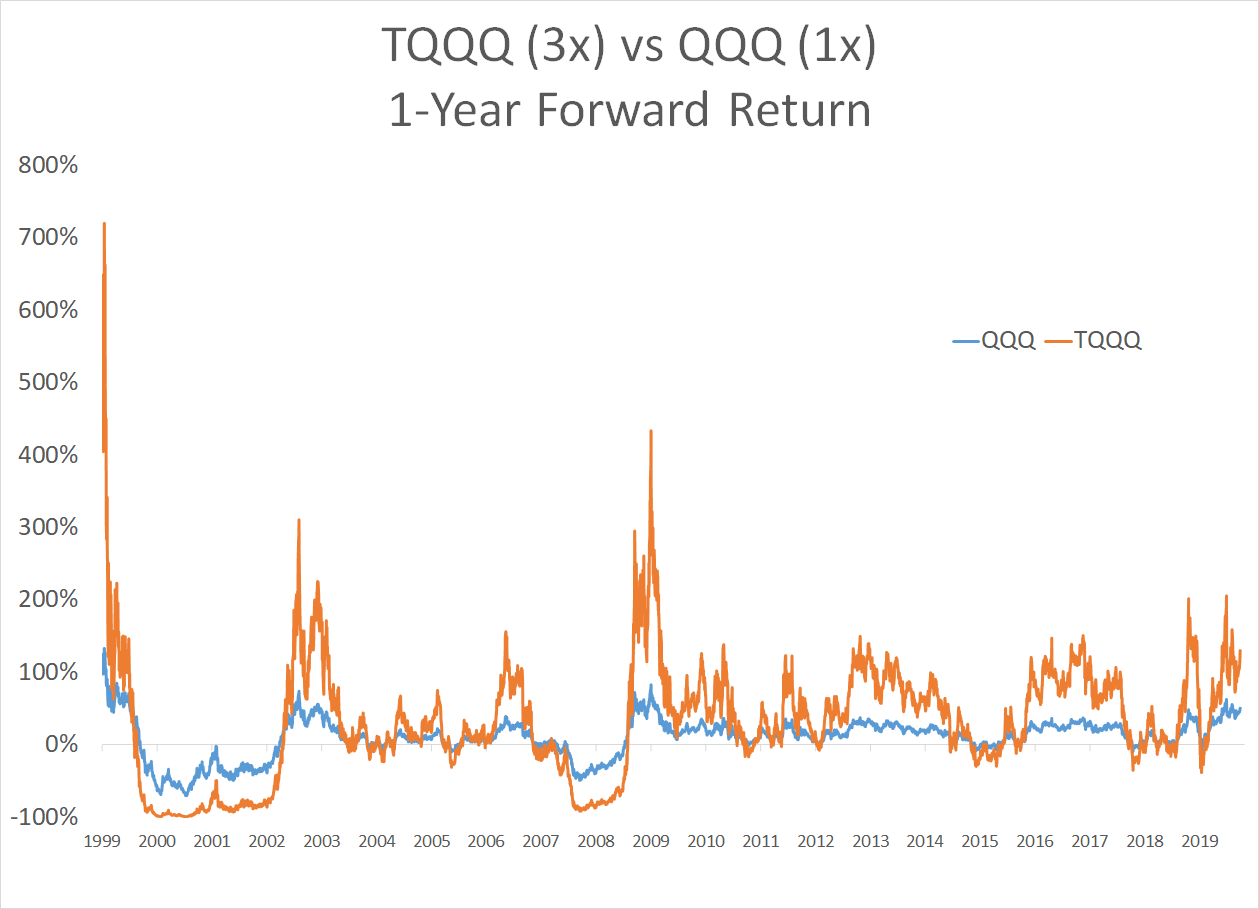

Tqqq Hold Long But Not Too Long A Data Driven Analysis Nasdaq Tqqq Seeking Alpha

Tqqq Hold Long But Not Too Long A Data Driven Analysis Nasdaq Tqqq Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Do All Leveraged Etfs Go To Zero Seeking Alpha

Comments

Post a Comment