Featured

Does Capital One Report Authorized Users To Credit Bureaus

Call your creditor and ask about their reporting policies. Your issuer doesnt report any authorized user activity.

Adding An Authorized User Credit Card Insider

Adding An Authorized User Credit Card Insider

Citi Bank Chase and Capital One do report.

Does capital one report authorized users to credit bureaus. I talked to Wells Fargo last night. I was recently added to a Capital One account as an authorized user. However both issuers in the past have suggested theres a negative trigger for when business accounts get reported to bureaus late or no payment for example.

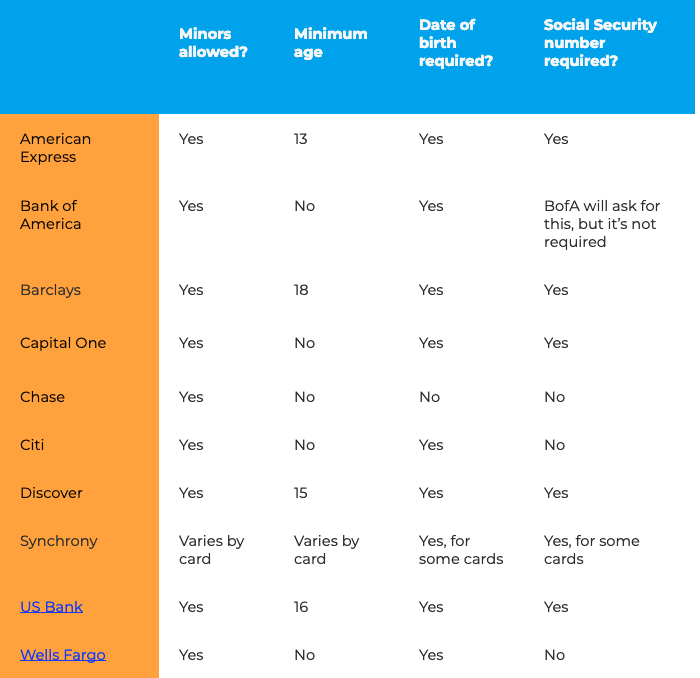

-- RBC Bank said they dont do it and wont report it the agent on the phone said we dont even know if your authorized user is a real person you could add your dog as an authorized user we dont check. Below 30 Utilization and ideally below 95 utlization. Barclays confirmed that it runs a credit check and reports users activity to both business and consumer credit bureaus.

One month and one statement letter I found that they did not report to any of the Credit Bureaus. So I called Capital One and asked if they report Authorized users to the Credit Bureaus. They do report authorized users to the credit bureaus.

A credit report will. Unlike other credit card companies they do not immediately report a new balance of 0. Every time you make an on-time credit card payment it will be reported to the national credit bureaus of Experian Equifax and TransUnion not only in your name but in the names of your authorized users as well.

When does Capital One update an account to the credit bureaus. I cached that interesting tidbit in case I ever want a credit card for my dog. While its common for issuers to report authorized user accounts its not mandatory.

I also asked if I can be put on the account as a joint account holder. Wells Fargo Citi Bank Chase and Capital One. How often Capital One reports to credit bureaus According to Capital One it typically provides your credit information to all three bureaus once per month.

The company doesnt specify the. Looks like 3 of them report for sure. Typically the entire account history will show up on the authorized users credit report says Gerri Detweiler education director for Nav which matches small businesses with loans and credit cards.

Each authorized user will receive his or her own credit card with his or. Still wondering if Wells Fargo does. The national credit card issuers that report authorized users to at least one bureau include.

Check to see if you qualify for secured cards with Discover or Capital one - with good payment history they will return deposit and turn insecure. The authorized user can access credit without applying for a card and your on-time payment history will show up on the users credit report as long as the card reports to credit bureaus. If you use your Capital One card responsibly youll give your authorized users a steady credit boost.

Capital One usually reports to the credit bureaus 3 days after the closing statement. The primary account holder on a credit card can add a number of authorized users to the account. 2-5 credit cards.

Because of this not all credit card companies choose to report their accounts to the authorized users credit history. If you need your balances to show 0 plan 3 days ahead of your closing statement. Out of the 4 banks I was wondering about.

Capital One authorized users only reports spousal accounts Chase. If they do report authorized user accounts you will typically see the account appear on your credit report within a couple of months after you are added to the account. If anyone has experience with them.

We typically share credit card account information with credit bureaus once a month. However some only report to two of the bureaus. If you want to add someone as an authorized user to your credit.

Become an authorized user to a relative or good friend with excellent credit report to help boost your own credit report. An authorized user can make purchases using the account but isnt responsible for repaying the debt. Being an authorized user on an account can help a person start building their credit history but only if the credit card company reports the authorized-user account to the national credit reporting companies.

Most travel credit card companies report to the Equifax Experian and TransUnion credit bureaus that you are an authorized user.

Adding An Authorized User With Capital One Creditcards Com

Adding An Authorized User With Capital One Creditcards Com

Which Credit Report Does Capital One Pull Mybanktracker

Which Credit Report Does Capital One Pull Mybanktracker

Does Capital One Report An Authorized User To Credit Bureaus Growing Savings

Does Capital One Report An Authorized User To Credit Bureaus Growing Savings

Adding An Authorized User Credit Card Insider

Adding An Authorized User Credit Card Insider

Capital One Platinum Credit Card Reviews May 2021 Credit Karma

Capital One Platinum Credit Card Reviews May 2021 Credit Karma

Does Capital One Report Authorized Users To Credit Bureaus

Does Capital One Report Authorized Users To Credit Bureaus

Adding An Authorized User Credit Card Insider

Adding An Authorized User Credit Card Insider

How To Add An Authorized User To Your Capital One Credit Card

How To Add An Authorized User To Your Capital One Credit Card

Adding An Authorized User Credit Card Insider

Adding An Authorized User Credit Card Insider

How To Boost Your Credit Score By Becoming An Authorized User

How To Boost Your Credit Score By Becoming An Authorized User

Which Credit Bureau Does Capital One Use 2021

Which Credit Bureau Does Capital One Use 2021

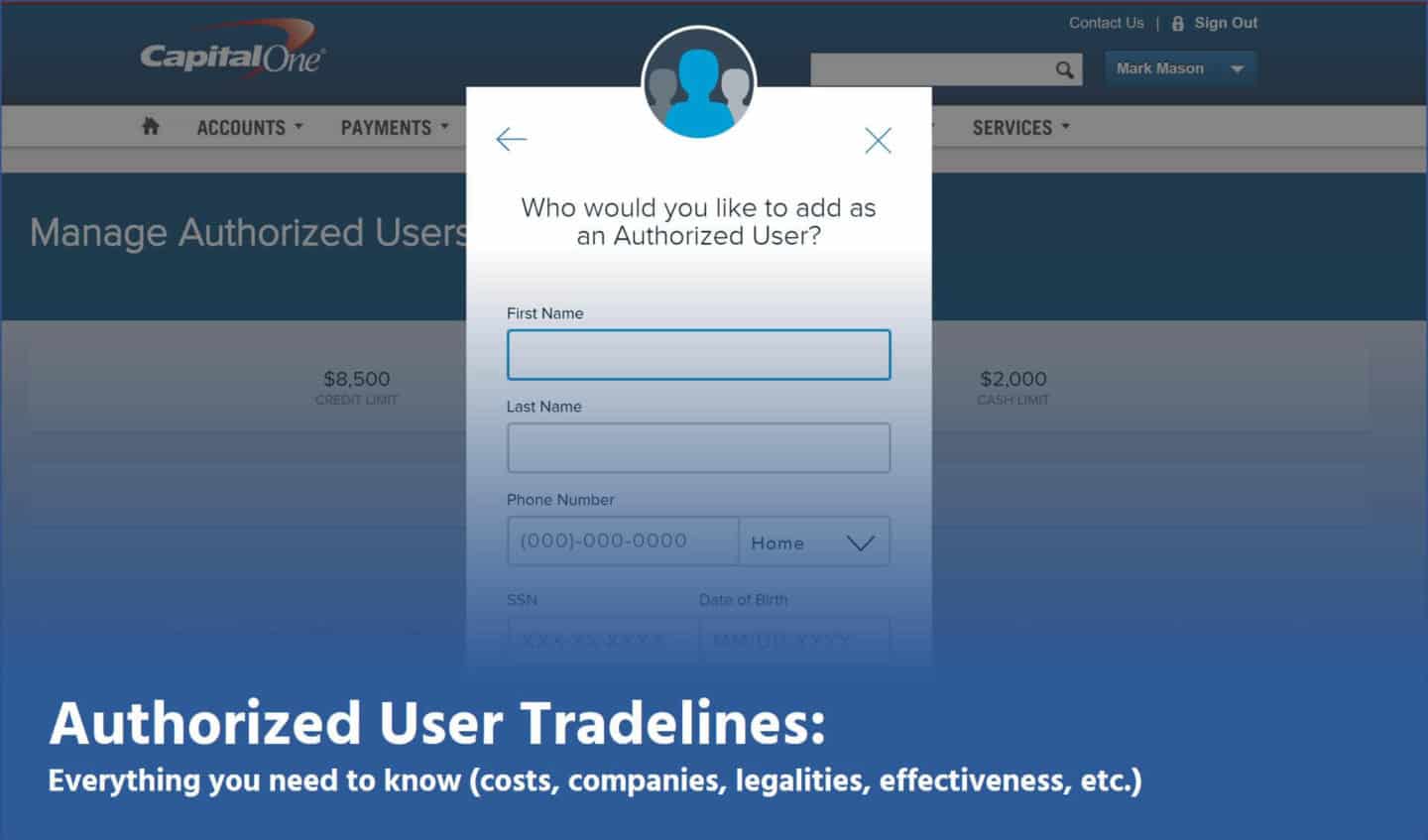

Authorized User Tradelines Everything You Need To Know In One Page

Authorized User Tradelines Everything You Need To Know In One Page

Does Capital One Report Authorized Users To Credit Bureaus Opera News

How Do Authorized Users Build Credit Self

How Do Authorized Users Build Credit Self

Comments

Post a Comment