Featured

Income Tax Refund Delay

Who is Affected by the Tax Refund Delays. Due to these implementations there is a delay in the income tax refund Here the taxpayers can check quick points for faster processing income tax refunds.

Income Tax Refund Stuck Steps To Take Reasons For Delay

Income Tax Refund Stuck Steps To Take Reasons For Delay

Part of this law includes.

Income tax refund delay. According to the Taxpayer Advocate Service an independent arm of the IRS. Although people had furnished the taxes in June-July and didnt get the tax refund then on their Twitter account. If you owe the IRS and cant pay this is what you should.

The IRS cant release these refunds before Feb. In its annual report to Congress the NTA already explained how returns that are flagged for privacy issues or simple identity verification can result in delayed refunds for taxpayers. If you request a refund check you might have to wait a few weeks for it to arrive.

So you could see a delay until the middle to end of February. The good news is that most taxpayers receive their refund within twenty-one days of filing but a common delay this year is because of another agencynamely the United States Postal Service. Also we added that how to track the status of tax refunds via the official portal.

15 but the IRS is saying to expect your refund by the first week of March. The Internal Revenue Service which encouraged taxpayers to file early for a speedier return maintains that most refunds will be issued within 21 days for taxpayers with direct deposit who file. The amended returns might take longer but hes seeing delays there too.

The 2018 amended return filed by paper as. The IRS is still estimating that 90 of people should receive their refunds within 21 days. There are several factors that can cause a delay in your tax return.

The IRS is falling behind in processing millions of income tax returns potentially delaying refunds for many Americans. A 2015 tax law called the Protecting Americans from Tax Hikes PATH Act created built-in certain rules to help protect against tax fraud and identity theft. The 2019 amended return was filed electronically and claims a 2857 refund.

Most taxpayers receive their refunds within 21 days. Mistakes on Your Return. That may require further identity verification and delay your tax refund.

NBC News Stephanie Ruhle breaks down reasons why many eligible Americans have not received their IRS tax refunds or third round of stimulus checks. If you file an incomplete return or if you have any mistakes on your tax return the IRS will spend longer processing your return. And while members praised the agency head for extending the April 15 tax filing deadline by a month to May 17 Rettig was reminded repeatedly by lawmakers that the refunds are a lifeline for some.

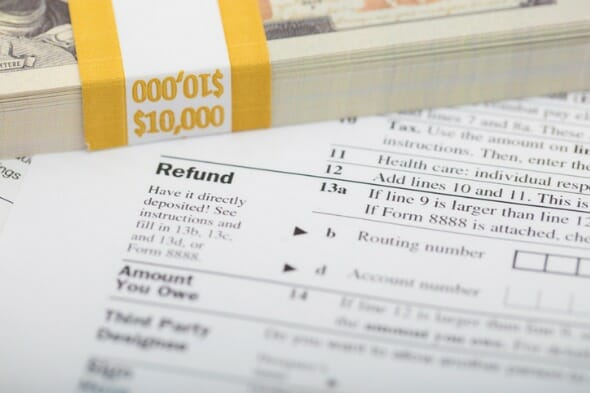

If you file early the IRS will hold your refund until February 15 and then begin processing your refund. Reason for Tax Refund Delay. The IRS is holding 29 million tax returns for manual processing delaying tax refunds for many Americans according to the National Taxpayer Advocate an independent arm of the tax agency that.

Claiming Earned Income Tax Credit or Additional Child Tax Credit. The 2019 amended return was filed electronically and claims a 2857 refund. Dont bother calling the IRS about the timing of your refund.

If you choose to have your refund deposited directly into your account you may have to wait five days before you can gain access to it. So how long a delay will my tax return have. Mistakes could include mathematical errors or incorrect personal information.

The 2018 amended return filed by paper as. However if you file a paper tax return expect delays. This will slow down any potential refund.

Delayed refunds containing the earned income tax credit EITC andor the additional child tax credit ACTC. Definitely dont file a second return which can cause an even longer delay. The IRS says nearly 7 million tax retunes have not been processed which is three times the total from last year.

The deadline is Jan. How Long Do I Have To Wait For My Refund. Typically you can expect to receive your tax refund less than 21 days after filing electronically.

The amended returns might take longer but hes seeing delays there too. The Internal Revenue Service is holding 29 million tax returns for manual processing contributing to more refund delays than are typical in a normal filing season due to sweeping tax code changes.

Why Income Tax Refund May Delay In Assessment Year 2020 21

Why Income Tax Refund May Delay In Assessment Year 2020 21

Haven T Received Income Tax Refund Yet Here S How You Can Raise A Re Issue Request Business News

Haven T Received Income Tax Refund Yet Here S How You Can Raise A Re Issue Request Business News

2021 Tax Refund Delays 2020 Tax Year Late Tax Refunds

2021 Tax Refund Delays 2020 Tax Year Late Tax Refunds

Why Your 2021 Early Tax Return Will Be Delayed This Year

Why Your 2021 Early Tax Return Will Be Delayed This Year

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Stimulus Check 2021 Millions Face Tax Refund Delay As Relief Arrives

Stimulus Check 2021 Millions Face Tax Refund Delay As Relief Arrives

Not Got Your Income Tax Refund Yet Here S What You Should Do By Corwhite Corp Issuu

Not Got Your Income Tax Refund Yet Here S What You Should Do By Corwhite Corp Issuu

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

2018 Income Tax Refunds Delayed For Child Tax Credit And Eitc Returns

2018 Income Tax Refunds Delayed For Child Tax Credit And Eitc Returns

Yet To Receive Your Tax Refund This Is What You Should Do

Yet To Receive Your Tax Refund This Is What You Should Do

Tax Return Irs Tax Refund 2021 Dates Reason For Delay How To Check And Avoid Errors Marca

Tax Return Irs Tax Refund 2021 Dates Reason For Delay How To Check And Avoid Errors Marca

Income Tax Refund Delayed File A Complaint With Tax Ombudsman

Income Tax Refund Delayed File A Complaint With Tax Ombudsman

Income Tax Refund Itr Payments Become Fast Modi Govt Shares This Interesting Data The Financial Express

Income Tax Refund Itr Payments Become Fast Modi Govt Shares This Interesting Data The Financial Express

Popular Posts

Aetna Better Health Insurance Phone Number

- Get link

- X

- Other Apps

Comments

Post a Comment