Featured

Michigan Tax Free Municipal Bonds

Changes in the credit rating of a bond or in the credit rating or financial strength of a bonds issuer insurer or guarantor may affect the bonds value. Such transaction data andor related information may not exist for all municipal securities and may not be required to be submitted to the MSRB for certain types of municipal.

A change that affects one project would likely affect all similar projects.

Michigan tax free municipal bonds. Bonds are designated X if. Eaton Vance Insured CA Municipal Bond II. DTF Tax Free Income.

The Michigan Municipal Bond Fund invests primarily in investment-grade municipal bonds and is designed to provide as high a level of current interest income exempt from regular federal state and in some cases local income taxes. Changes in the credit rating of a bond or in the credit rating or financial strength of a bonds issuer insurer or guarantor may affect the bonds value. That means depending on where you live you may never owe income taxes on the payments you receive from the bonds issuer but they may be subject to the alternative minimum tax or AMT.

The transaction data provided through the Real-Time Transaction Subscription Service represents municipal securities transaction data made available by brokers dealers and municipal securities dealers to the MSRB and related information. Municipal bonds are federally tax-free and in some cases are free from state and local taxes too. Duff Phelps Investment Mgmt.

52 Zeilen State Taxation of Municipal Bonds for Individuals Notes. The fund may invest a significant part of its assets in municipal securities that finance similar types of projects. The maximum beneficiaries are those in the 25 or higher federal income tax bracket for 2010 single people with taxable income of 34000 or more and marrieds with taxable income of 68000 and more.

Tax-free municipal bonds for individual investors We are municipal bond specialists and own the bonds we sell which enables clients to invest knowledgeably and with confidence. The MFS Municipal High Income Fund MMHYX 826 is another high-yield municipal bond fund that has a similar mandate and focus as ACTHX similar duration 92 years in. The fund normally invests at least 80 of its assets in investment-grade municipal securities whose interest is exempt from federal and Michigan personal income taxes.

Michigan bonds Michigan Municipal Bonds offer tax-free income to investors. It may invest up to 20 of its net assets in below investment grade municipal bonds commonly referred to as high yield or junk bonds. Dreyfus Strategic Municipal Bond Fund.

The objective of issuing these bonds is to provide low cost capital financing to various governmental entities. If you buy bonds. Such transaction data andor related information may not exist for all municipal securities and may not be required to be submitted to the MSRB for certain types of municipal.

You can invest in a variety of revenue general obligation and other Michigan municipal bonds. Sometimes the IRS can be friendly to investors particularly in the case of municipal bonds which are exempt from federal income tax. The fund may invest a significant part of its assets in municipal securities that finance similar types of projects such as utilities hospitals higher education and transportation.

A municipal bond also known as a muni is debt security used to fund capital expenditures for a county municipality or state. It invests more than 25 of. The transaction data provided through the Real-Time Transaction Subscription Service represents municipal securities transaction data made available by brokers dealers and municipal securities dealers to the MSRB and related information.

These types of tax-free income funds are usually municipal bond funds. MI Dept of Treasury - the bond process finance teams lost bonds and links to other resources. Municipal bonds are not for everyone and are best suited to those who can get maximum benefit from the tax free savings.

Puerto Rico municipal bonds have been impacted by recent adverse economic and market changes which may cause the funds share price to decline. A tax-free fund is an investment that pays dividends that are not taxable.

What S In My Bond Fund The Detroit Bankruptcy And Its Impact On Muni Bond Portfolios Morningstar

What S In My Bond Fund The Detroit Bankruptcy And Its Impact On Muni Bond Portfolios Morningstar

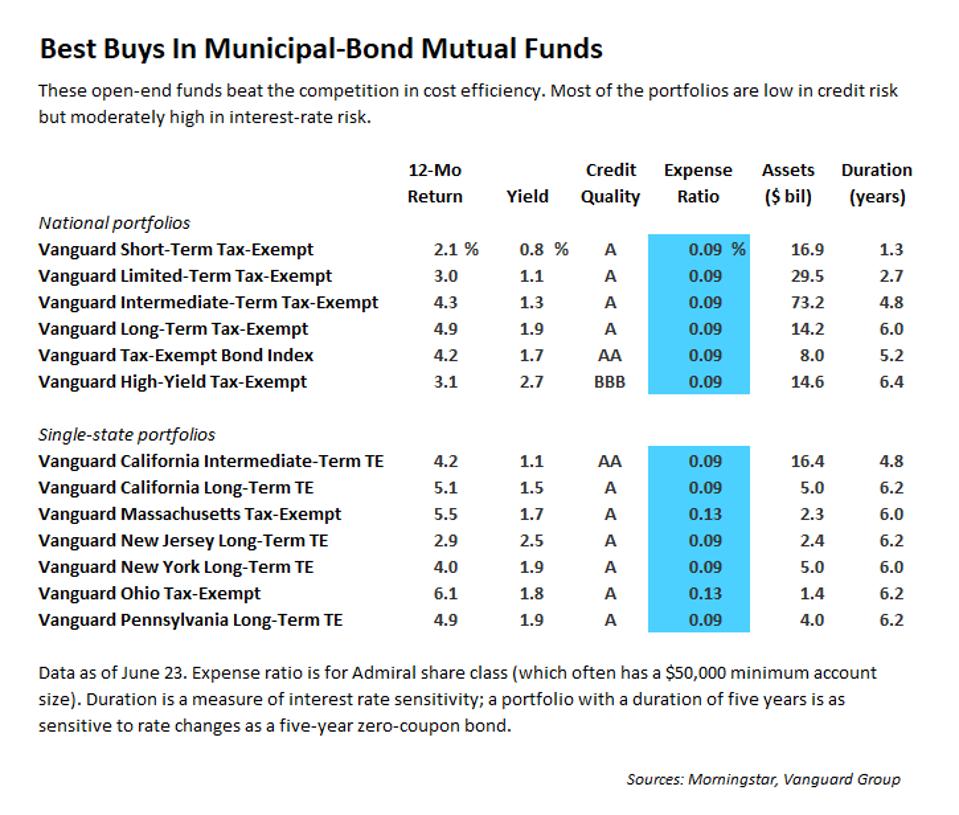

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

/municipal-bonds-what-are-they-and-how-do-they-work-3305607-FINAL-75578b195af448588b93a7fced720a97.png) Municipal Bonds Definition How They Work Threats

Municipal Bonds Definition How They Work Threats

The Definitive Resource For Michigan Municipal Bonds

The Definitive Resource For Michigan Municipal Bonds

Treasury Michigan Municipal Bond Authority

Treasury Michigan Municipal Bond Authority

![]() Municipal Bond Funds Franklin Templeton

Municipal Bond Funds Franklin Templeton

Lessons From One Week In The Muni Bond New Issue Market Lord Abbett

Lessons From One Week In The Muni Bond New Issue Market Lord Abbett

Where To Find Safe 5 Yields Barron S

Where To Find Safe 5 Yields Barron S

A Reality Check On The Municipal Bond Market Lord Abbett

A Reality Check On The Municipal Bond Market Lord Abbett

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

Comments

Post a Comment