Featured

Donald Trump's Tax Cuts

Sitting in the Oval Office on Dec. There surrounded by the wealthy men and women whod paid.

Donald Trump Promises Tax Cuts Offset By Robust Growth Wsj

Donald Trump Promises Tax Cuts Offset By Robust Growth Wsj

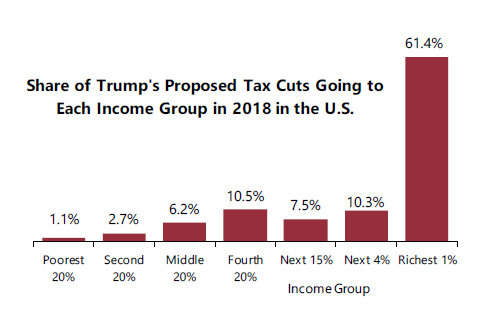

Donald Trumps tax package the top 01 of US households were granted a 25 tax cut that pushed their rate below that of the lower 50 of US earners.

Donald trump's tax cuts. Trumps tax cuts. The Trump administration said it would generate 18 trillion in revenue more than making up for its 15 trillion cost. Since then the debt-to-gross domestic product GDP ratio decreased slightly before resuming its upward trajectory by the end of 2019.

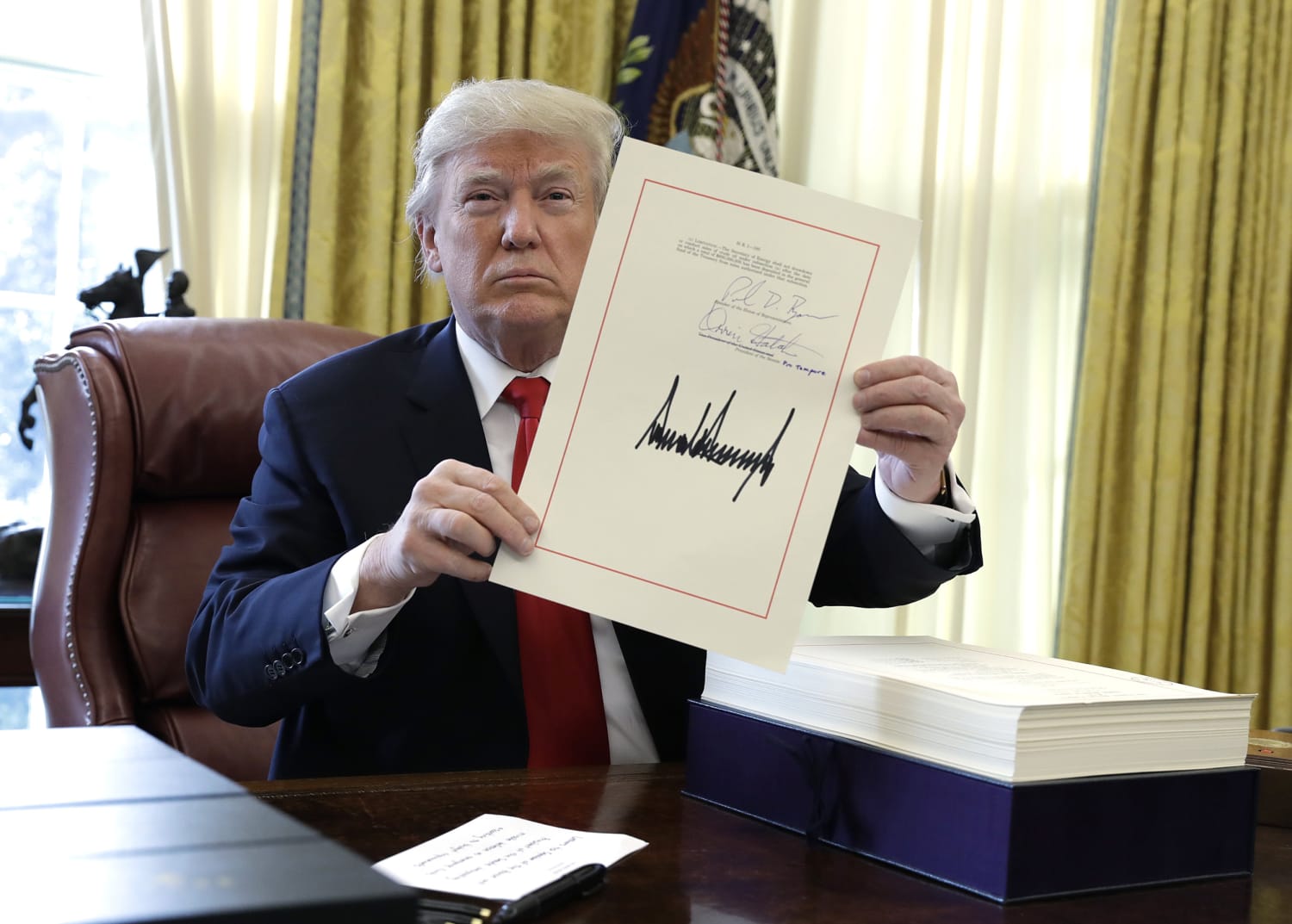

Bidens families plan which provides universal free pre-K and community college and implements national paid family leave wont nix a business tax deduction included in the 2017 Tax Cuts and Jobs Act TCJA CNBC reportedThe provision allows owners of pass-through entities which are often small businesses to deduct 20 of their share of the business income from their tax. 22 2017 bringing sweeping changes to the tax code. Most of the changes took effect on January 1 2018.

The Tax Cuts and Jobs Act TCJAreflecting President Trumps planwas ultimately signed into law on Dec. It went into effect on Jan. President Trump will no doubt want voters to give him credit for his tax law which he promised would lead to more investment more jobs higher wages and faster growth.

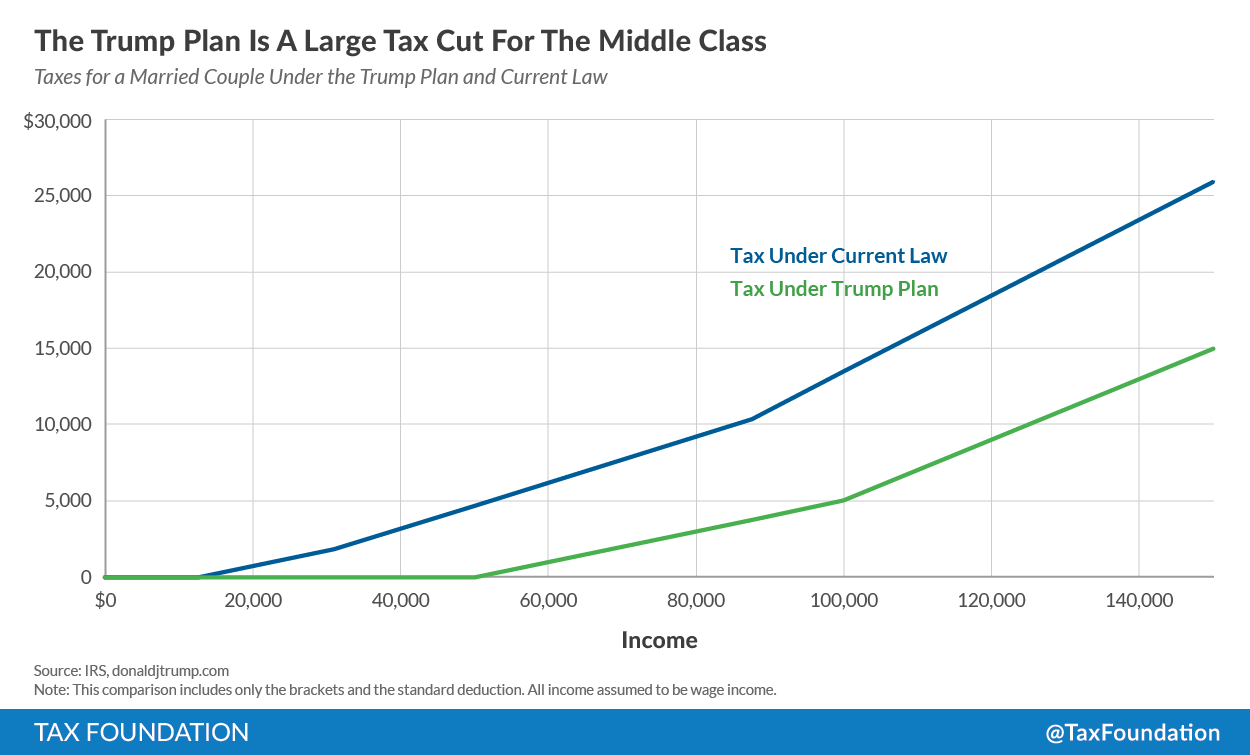

The top individual tax rate dropped from 396 to 37 and numerous itemized deductions were eliminated or affected as well. However some TCJA provisions went into effect in. The center estimated that 82 percent of middle-class Americans received tax cuts in 2018 with cuts averaging between 1260 and 1330.

But none of those. However Democrats did a fantastic job messaging that only the wealthy saved money with Trumps tax reform as only 40 percent of Americans actually believed they got a tax cut a 2019 New York Times SurveyMonkey poll. During the 2020 presidential campaign then-Vice President Joe Biden vowed to roll back the tax cuts passed by Republicans and signed by President Donald Trump in 2017.

So here are the results of the Trump tax cuts. There are three estimates of the cost of Trumps tax cuts. The four signature policy achievements of Trumps presidency were a massive tax cut that largely benefitted the most affluent Americans and major corporations a more conservative federal.

President Trump signed the Tax Cuts and Jobs Act of 2017 TCJA into law on December 22 2017. Trump signed the tax cuts into law. 4 ways they changed the American economy - CNN.

President Trump signed the Tax Cuts and Jobs Act TCJA into law on Dec. At his first press conference since taking office President Joe Biden claimed that 83 percent of Donald Trumps 2017 tax cut went to the top 1 one percent of earners. It was and remains the presidents most significant legislative achievement.

Soon after President Donald Trump signed the Tax Cuts and Jobs Act into law in December 2017 he traveled to his private club in Florida. --The income tax burden for high earners increased 16 billion to 40 percent of the total owed. The JCT said the TCJA would increase the deficit by 1 trillion but that does not include the impact of the FY 2018.

How people feel about the 15 trillion. President Donald Trump signed the Tax Cuts and Jobs Act TCJA on Dec. It cut individual income tax rates doubled the standard deduction and eliminated personal exemptions from the tax code.

US President Donald Trump speaks about tax cuts for Americans from the Rose Garden at the White. AFP via Getty Images President Trump signed the Tax Cut and Jobs Act into law in December.

Donald Trump Claims Tax Cuts Have Led To Economic Miracle As Trade War Looms Donald Trump The Guardian

Donald Trump Claims Tax Cuts Have Led To Economic Miracle As Trade War Looms Donald Trump The Guardian

Tax Cuts And Jobs Act Of 2017 Wikipedia

Tax Cuts And Jobs Act Of 2017 Wikipedia

Sorting Through The Fallacies In Trump S Missouri Tax Speech Itep

Sorting Through The Fallacies In Trump S Missouri Tax Speech Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/6100607/How_tax_plans_compare.0.jpg) The Huge Republican Tax Cut Plans In 4 Charts Vox

The Huge Republican Tax Cut Plans In 4 Charts Vox

Donald Trump S Tax Cuts What To Expect Money

Donald Trump S Tax Cuts What To Expect Money

How Would Trump S Tax Cuts Affect Different Taxpayers Tax Policy Center

How Would Trump S Tax Cuts Affect Different Taxpayers Tax Policy Center

News Analysis Trump S Tax Cuts Will Be Big Win For U S Economy In 2018 But Poor May Not See Benefits Xinhua English News Cn

Donald Trump S Tax Plan Is A Large Tax Cut For The Middle Class Tax Foundation

Donald Trump S Tax Plan Is A Large Tax Cut For The Middle Class Tax Foundation

On Tax Day Trump Tax Cuts Remain Deeply Unpopular Politico

On Tax Day Trump Tax Cuts Remain Deeply Unpopular Politico

European Business Execs Applaud Donald Trump S Tax Cuts At Davos News Dw 26 01 2018

European Business Execs Applaud Donald Trump S Tax Cuts At Davos News Dw 26 01 2018

Tax Cuts And Jobs Act Of 2017 Wikipedia

Tax Cuts And Jobs Act Of 2017 Wikipedia

Trump S Tax Cuts Aren T Paying For Themselves Quartz

Trump S Tax Cuts Aren T Paying For Themselves Quartz

Trump S Tax Cut Isn T Giving The Us Economy The Boost It Needs

Trump S Tax Cut Isn T Giving The Us Economy The Boost It Needs

Trump Signs Tax Cut Bill First Big Legislative Win

Trump Signs Tax Cut Bill First Big Legislative Win

Comments

Post a Comment