Featured

- Get link

- X

- Other Apps

Arkk Etf Holdings Morningstar

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ETF before investing. ARKK is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily at least 65 of its assets in domestic and foreign equity securities of companies that are relevant to the Funds investment theme of disruptive innovation.

Digging Into Ark Innovation S Portfolio Morningstar

Digging Into Ark Innovation S Portfolio Morningstar

ETPs Prospectus Stated Objectives.

Arkk etf holdings morningstar. XT tracks the Morningstar. The investment seeks long-term growth of capital. ARKK Fund Description.

Top Performing Canadian ETFs in 2020. The difference between ARKK and ARKW. ARK Invests ARK Innovation ETF ARKK had a stellar 2020 delivering a 150 return and luring in more than 10 billion in fresh investor allocations during the year.

Morningstar provides stock market analysis. Top holdings include networking equipment. That their staff are younger and potentially less experienced has been noted by others.

Yahoo partners with Morningstar a leading market research and investment data group to help investors rate and compare funds on Yahoo Finance. ARK Innovation ETF - Fund Holdings. ARKW only invests in ARKs Next Generation Internet theme while ARKK invests in all 4 of ARKs themes.

Cathie Wood Isnt Worried About Inflation. Its flagship strategy ARK Innovation ARKK earns a Morningstar Analyst Rating of Neutral. Equity mutual fund and ETF research ratings and picks.

And thats just what Catherine Wood and her team do at the ARK Innovation ETF NYSEArca. ARKK and other tech growth funds in general had a big drop from Feb 12th - March 8th which isnt a problem specific to ARK. 11 rows View Top Holdings and Key Holding Information for ARK Innovation ETF ARKK.

Its flagship strategy ARK Innovation ARKK earns a Morningstar Analyst Rating of Neutral. The investment seeks long-term growth of capitalThe fund is an actively-managed exchange-traded fund ETF that will invest under normal circumstances primarily at least 65 of its assets in domestic and foreign equity securities of companies that are relevant to the funds investment theme of disruptive innovation. Our reliable data and analysis can help both experienced enthusiasts and newcomers.

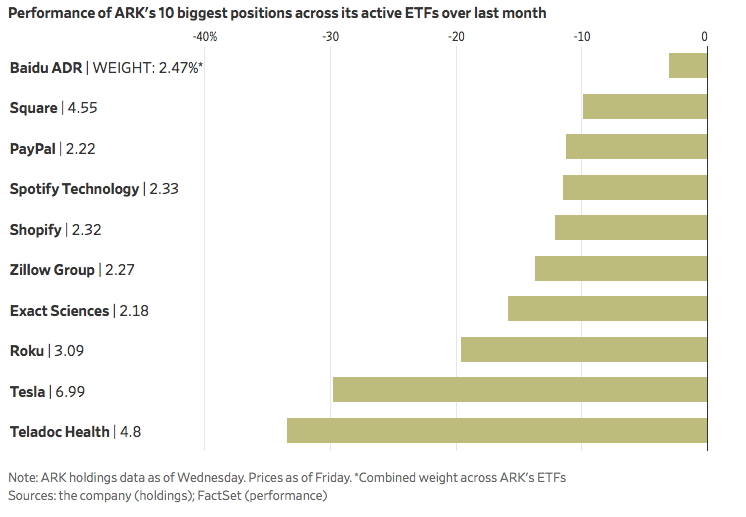

Tesla made up 97 of the Ark Innovation ETF ARKK as of Thursday down from 109 a month ago with a net sale of about 252000 shares over that period according to portfolio listings on the website of fund manager Ark Invest. The principal risks of investing in ARK ETFs include equity market management and non-diversification risks as well as fluctuations in market value and net asset value NAV. My morningstar 5-star rated tech ETFs and others also tanked and havent yet fully recovered.

ARK Innovations Thematic Approach Is Ill-Prepared for a Major Twist. It was a year of low-cost rocket ships here are the top ten. The fund is an actively-managed exchange-traded fund ETF that will invest under normal circumstances primarily at least 65 of its assets in domestic and foreign equity securities of companies that are relevant to the funds investment theme of disruptive innovation.

ARKK is an actively managed fund that seeks long-term capital growth from companies globally involved with or that benefit from disruptive innovation. The CEO of ARK Invest believes that the bull market has broadened out into value. Here is an in-depth comparison between these 2 ETFs.

And option hedge fund IRA 401k and 529 plan research. ARKK and ARKW are 2 ETFs managed by ARK Invest. For example ARKKs sixth-largest holding as of February 1 2021 the genetic-testing company Invitae has average daily trading volume of.

Get up to date fund holdings for ARK Innovation ETF from Zacks Investment Research. 26 rows ARKK top holdings including current price and weighting. As such ARKK is a more diversified ETF compared to ARKW.

No One S Arkk Ark Innovation Etf Offers No Shelter From A Stormy Stock Market Seeking Alpha

No One S Arkk Ark Innovation Etf Offers No Shelter From A Stormy Stock Market Seeking Alpha

Arkk Access To Companies On The Cusp Of Disruptive Tech Etf Trends

Arkk Access To Companies On The Cusp Of Disruptive Tech Etf Trends

Digging Into Ark Innovation S Portfolio Morningstar

Digging Into Ark Innovation S Portfolio Morningstar

Tom Lauricella On Twitter The Story Around Ark Innovation S Simply Massive Inflows Is Only One Piece Of The Puzzle Arkk

Tom Lauricella On Twitter The Story Around Ark Innovation S Simply Massive Inflows Is Only One Piece Of The Puzzle Arkk

Bond Etfs Are On Track For A Banner Year Morningstar

Bond Etfs Are On Track For A Banner Year Morningstar

Ark Innovation S Approach Is Ill Prepared Morningstar

Ark Innovation S Approach Is Ill Prepared Morningstar

A Risky But Promising Innovation Etf Morningstar

A Risky But Promising Innovation Etf Morningstar

Morningstar Warns About Ark Innovation Etf Risks Fund Selector Asia

Morningstar Warns About Ark Innovation Etf Risks Fund Selector Asia

No Room On The Ark Morningstar

No Room On The Ark Morningstar

Inside Ark Innovation S Big Stakes In Small Companies Morningstar

Inside Ark Innovation S Big Stakes In Small Companies Morningstar

A Risky But Promising Innovation Etf Morningstar

A Risky But Promising Innovation Etf Morningstar

Digging Into Ark Innovation S Portfolio Morningstar

Bond Etfs Are On Track For A Banner Year Morningstar

Bond Etfs Are On Track For A Banner Year Morningstar

Comments

Post a Comment