Featured

Atlanta Tax Rate

The Georgia GA state sales tax rate is currently 4. Together with the 5 that puts us pretty close to taxes in Boston New York Houston Portland Indianapolis.

State Corporate Income Tax Rates And Brackets For 2018 Tax Foundation

State Corporate Income Tax Rates And Brackets For 2018 Tax Foundation

Penalty and Interest Assessments Prescribed by Atlantas Code of Ordinances.

Atlanta tax rate. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The 1 MOST does not apply to sales of motor vehicles. The tax rate exclusive of that is 15 in Atlanta Fulton County.

Depending on the zipcode the sales tax rate of Atlanta may vary from 4 to 89. 694 lignes Tax Rate. If you earn more than that then youll be taxed 2 on income between 750 and 2250.

PROPOSED TAX RATE 0655375 per I 00. Im not saying I like the tax. GA Sales Tax Rate.

Because Clayton County first. Every 2021 combined rates mentioned above are the results of Georgia state rate 4 the county rate 2 to 4 the Atlanta tax rate 0 to 15 and in some case special rate 0 to 1. The December 2020 total local sales tax rate was also 8900.

The sales tax jurisdiction name is Atlanta Fulton Co which may refer to a local government division. The Atlanta Sales Tax is collected by the merchant on all qualifying sales made within Atlanta. The County sales tax rate is.

The Atlanta Georgia sales tax is 400 the same as the Georgia state sales tax. A tax rate of 655375 per 100 valuation has been proposed by the governing body of City of Atlanta. 160 lignes Note that Atlanta is the only city with its own sales tax and when.

The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special tax. The minimum combined 2021 sales tax rate for Atlanta Georgia is. Hartsfield-Jackson Atlanta International Airport ATL 6000 N Terminal Pkwy Atlanta Georgia 30337 United States to Peachtree Road Atlanta Georgia 30305 United States.

Depending on local municipalities the total tax rate can be as high as 9. General business licenses LGB are subject to a 15 interest assessment on unpaid principal. Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses.

While many other states allow counties and other localities to collect a local option sales tax Georgia does not permit local sales taxes to be collected. In Atlanta as well as in most of the counties in the state assessment ratio of 40 is used. General business licenses LGB are subject to a 500 penalty for failing to renew their business license by February 15 annually.

4676 232 Forsyth Street Southwest Atlanta Georgia 30303 United States to 300 Wendell Court Southwest Atlanta Georgia 30336 United States. This means that if your homes market value is 200000 the assessed value is 80000. The Atlanta sales tax rate is.

CITY OF MOUNTAIN PARK. Im just saying it doesnt make Atlanta some crazy outlier. The Georgia sales tax rate is currently.

Furthermore economic nexus may be triggered. The current total local sales tax rate in Atlanta GA is 8900. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

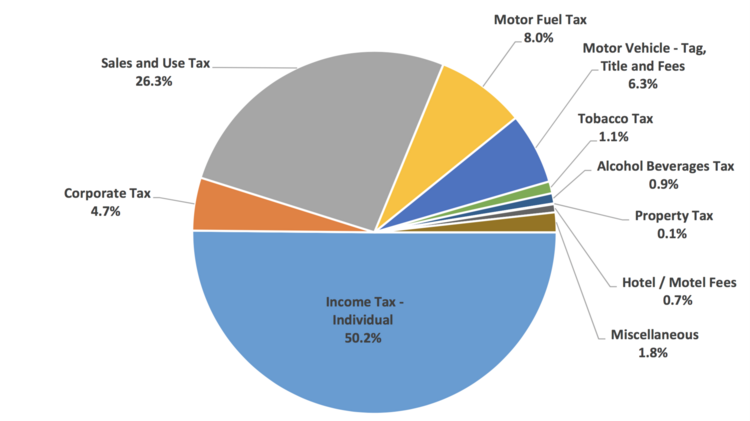

This is the total of state county and city sales tax rates. Atlantas Property Tax Rates The property tax rates statewide are described in mills equal to 1 of taxes for every 1000 in assessed value. Georgia Median Household Income If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750.

CITY OF HOLLY SPRINGS. 101 lignes The 30303 Atlanta Georgia general sales tax rate is 89.

Georgia Sales And Use Tax Rates Lookup By City Zip2tax Llc

Georgia Sales And Use Tax Rates Lookup By City Zip2tax Llc

Https Www Atlantaga Gov Home Showdocument Id 18844

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

How High Is Georgia S Corporate Tax Rate Atlanta Business Chronicle

Where Georgia Tax Rate Ranks Among States Atlanta Ga Patch

Where Georgia Tax Rate Ranks Among States Atlanta Ga Patch

The Hunt For The Right Sales Tax Rate Wacky Tax Wednesday

The Hunt For The Right Sales Tax Rate Wacky Tax Wednesday

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Lawmakers Might Come To Regret Georgia S Risky Tax Plan Georgia Budget And Policy Institute

Lawmakers Might Come To Regret Georgia S Risky Tax Plan Georgia Budget And Policy Institute

Atlanta Georgia Sales Tax Rate 2016 Rating Walls

Atlanta Georgia Sales Tax Rate 2016 Rating Walls

Georgia Income Tax Calculator Smartasset

Georgia Income Tax Calculator Smartasset

Barrow County Georgia Tax Rates

Comments

Post a Comment