Featured

Hedge Fund Portfolio Manager

For example a manager can hold a long position in a retailer and they are thinking about closing it but they are not sure. FIS Hedge Fund Portfolio Manager formerly VPM is a real-time multi-currency accounting and position management solution for hedge funds and hedge fund administrators.

My Control Freak Boss Demanded I Call Him Every 5 Minutes When He Was On Vacation The Brutal Life Of A Hedge Fund Analyst Efinancialcareers

My Control Freak Boss Demanded I Call Him Every 5 Minutes When He Was On Vacation The Brutal Life Of A Hedge Fund Analyst Efinancialcareers

It is available as an all-inclusive solution or via a la carte modules allowing clients to pay only for what is needed.

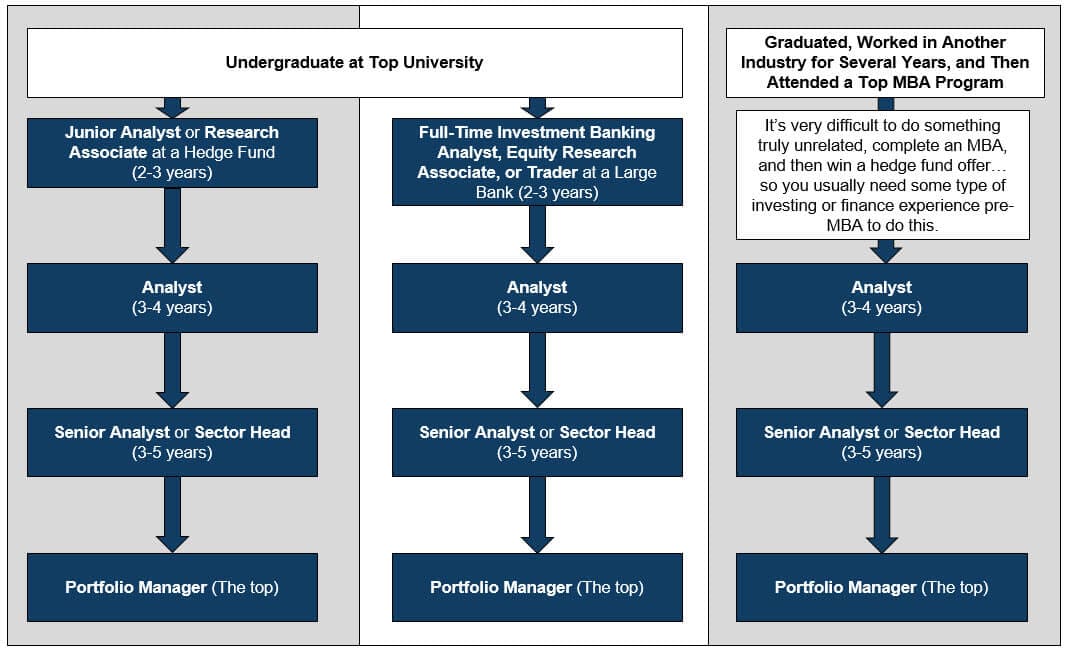

Hedge fund portfolio manager. Fundamental hedge fund managers normally use alternative data to reinforce their investment thesis that they derived from their regular research process. Being a Portfolio Manager is typically an ending goal for anyone who works at the buy side. The youngest hedge fund manager on The Forbes 400hes 45has had a stellar year with Tiger Global Management the investment firm he.

Most people often choose to stay as a Fund Manager for a long time. James Simons is the founder of the highly regarded quantitative hedge fund firm Renaissance Technologies. He is a Portfolio Manager for the Kolona Flagship Fund LP a global macro hedge fund.

Ranked 1 out of 200 Hedge Fund Managers. What Does a Portfolio Manager Do. Again the sale of the put will offset part of the cost of the bought put.

A regular investment fund. FundsTOTAL Manager is feature-rich yet remarkably easy-to-use. Connecting front- middle- and back-office operations Hedge Fund Portfolio Manager lowers your total cost of ownership and optimizes data.

Switch funds to one that is willing to take a chance. The easiest way is to work for a fund that internally promotes but getting a hedge fund analyst job can be very difficult so it is unlikely you will be able to be so picky that you can wait for a spot to become available at a fund that is open to internal promotes. Portfolio managers and hedge fund managers both meet with current and prospective clients.

At single-manager funds SM funds the PM started or took over the fund and has responsibility for everything that happens. A portfolio manager is much more closely regulated than a hedge fund manager. His total hedge fund income was.

Portfolio managers review reports that provide relevant data. In this example the portfolio would only be hedged. Managers of hedge funds use particular trading strategies and instruments with the specific aim of reducing market risks to produce risk-adjusted returns that are consistent with investors desired level of risk.

See Full Profile. Average Return 3 Years annualized Followed by 11918 Investors. For example a portfolio manager can buy a put with a strike price at 95 of the spot price and sell a put with an 85 strike.

Prior to launching Kolona Anthony worked at a large multi-family office where he ran the Flagship Dividend Growth Fund launched the firms Private Equity Strategy and sat on the firms Investment Committee and Compliance Committee. Exit opportunities for Fund Managers. Difference Between Hedge Fund Manager and Portfolio Manager Regulation.

The Portfolio Manager sits at or near the top of the hedge-fund hierarchy. FundsTOTAL Manager enables hedge funds to effectively manage and analyze portfolios quantify risk measure performance and collaborate with colleagues. Finance portfolio manager hedge fund Job Type.

Go to a multi manager. A hedge fund manager is a financial company or individual that employs professional portfolio managers and analysts in order to establish hedge funds. I want to go back and re-emphasize the qualitative aspect of our investment process.

The investors invest their money into the PMs investment policy for future fund growth such as a retirement fund endowment fund education fund or for other purposes. Because of stricter regulations a portfolio manager needs to use a simpler trading strategy. The longshort hedge fund portfolio manager is devoting his money to this fundamental economic position.

A portfolio manager PM is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. Portfolio Value Total assets under management. Thus working in Mutual Fund ETF seems to be more balanced work-life than in Investment Banking 90-100 hoursweek and Hedge Fund 60-80 hoursweek.

For an investor who already holds large quantities of equities and bonds investment in hedge funds may provide diversification and reduce the overall portfolio risk.

Hedge Fund Career Path Job Titles Salaries Promotions

Hedge Fund Career Path Job Titles Salaries Promotions

Insight Investment The Hedge Fund Journal

Insight Investment The Hedge Fund Journal

Hedge Funds Battered In 2008 Bracing For Worse

Hedge Funds Battered In 2008 Bracing For Worse

My Career Path From Hft Cop To Investment Banker To Hedge Fund Pm To Data Startup Efinancialcareers

My Career Path From Hft Cop To Investment Banker To Hedge Fund Pm To Data Startup Efinancialcareers

Hedge Fund Analyst Street Of Walls

Hedge Funds Risky Investment Or Portfolio Diversifier Inside Indiana Business

Hedge Funds Risky Investment Or Portfolio Diversifier Inside Indiana Business

Sac Hedge Fund Manager Michael Steinberg Sentenced To Prison Time

Sac Hedge Fund Manager Michael Steinberg Sentenced To Prison Time

Hese Are The 14 Characteristics That Make An Outstanding Hedge Fund Manager Varchev Finance

Hese Are The 14 Characteristics That Make An Outstanding Hedge Fund Manager Varchev Finance

Verrazzano Capital The Hedge Fund Journal

Verrazzano Capital The Hedge Fund Journal

Hedge Fund Portfolio Manager Job From Salaries Day In The Life

Hedge Fund Portfolio Manager Job From Salaries Day In The Life

This Conferencing Solution Keeps Hedge Fund Portfolio Manager Traders In Contact Commercial Integrator

This Conferencing Solution Keeps Hedge Fund Portfolio Manager Traders In Contact Commercial Integrator

Long Short Hedge Fund Portfolio Manager The Wall Street Transcript

Long Short Hedge Fund Portfolio Manager The Wall Street Transcript

Hedge Fund Manager Getting Noticed In Colorado Vaildaily Com

Hedge Fund Manager Getting Noticed In Colorado Vaildaily Com

Hedge Fund Manager Michael Steinberg Charged With Insider Trading The Denver Post

Hedge Fund Manager Michael Steinberg Charged With Insider Trading The Denver Post

Comments

Post a Comment