Featured

How Many Credit Scores Are There

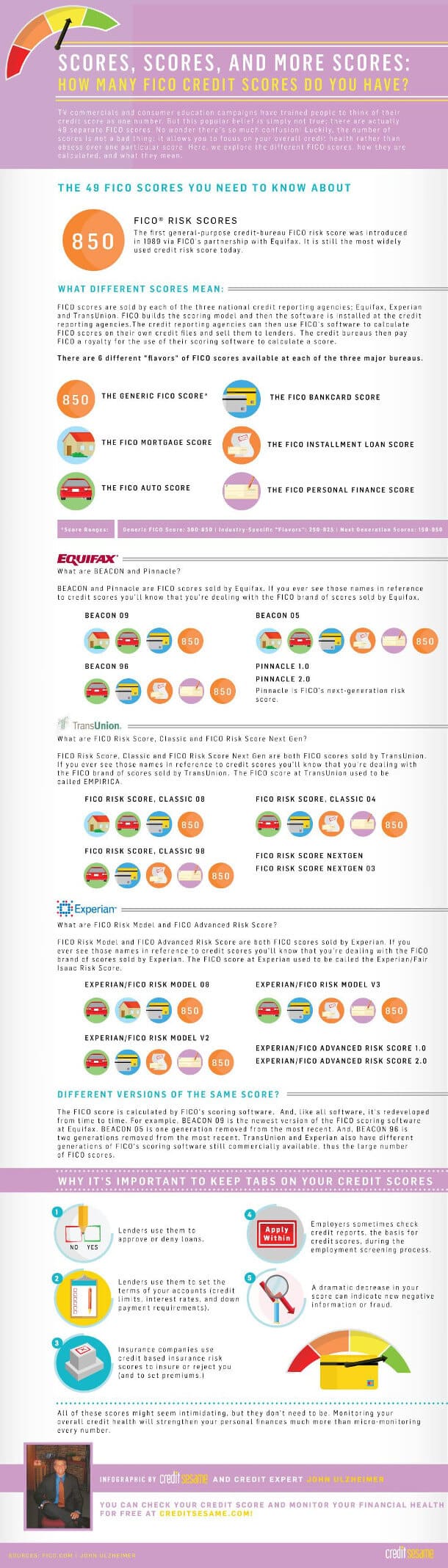

Fair Isaac Corp more commonly known as FICO has about 50 scores a 2012 report from the Consumer Financial Protection Bureau puts that number at 49. A credit score is a three-digit number thats calculated by applying a mathematical algorithm to the information in one of your three credit reports which are generally updated each month.

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

The reality is there are over 60 different types of credit scores.

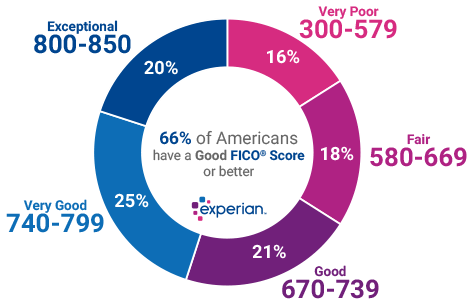

How many credit scores are there. That clears things up doesnt it. The versions range from 250-900 compared to 300-850 for base FICO Scores and higher scores continue to equate to lower risk. The higher your score the better your odds of being approved for loans and lines of credit at the most favorable interest.

In the US there are three national credit bureaus Equifax Experian and TransUnion that compete to capture update and store credit histories on most US. That can translate to significant. Creditors are not required to report to all three credit bureaus.

Many lenders use Scorelogixs JSS score in addition to bureau scores. How many credit cards should you have if you want an excellent credit score. How Many Credit Scores Are There - Instant 3-bureau scores see your credit scores online and monitor your credit files anytime.

The FICO score is by far the most popular type of credit score. Each report may have different information depending on how your creditors report your accounts. There are hundreds of algorithms companies use to score consumers and even the most common credit scoring company has dozens of models.

While youve probably heard of Fair Isaac Corporations FICO score before. Generally the higher your credit score the more likely you are to receive favorable terms on a loan like lower interest rates and higher dollar limits. Multiple credit reports means multiple credit scores.

VantageScore launched its scoring model through Equifax Experian and TransUnion in 2006 as an. No actually there are dozens. Why are my FICO Scores different for the 3 credit bureaus.

Is there anything actually good about having this confusing assortment of credit bureaus whose scores. The same reporting agency could have 19 different FICO scores. So your credit reports may contain different information which can cause you to have.

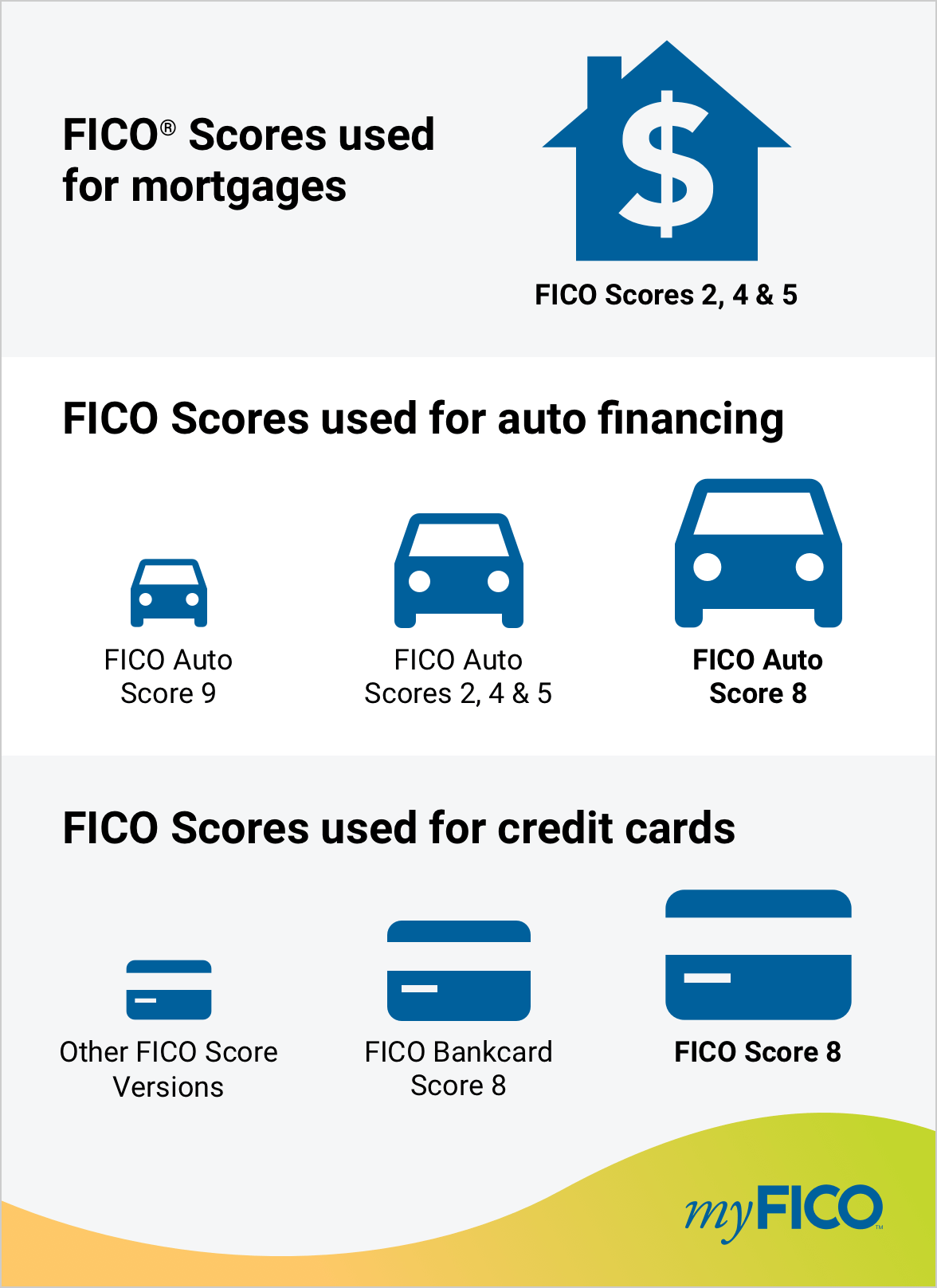

There are 49 different FICO scores sold by Fair Isaac and Co each targeting a different lending requirement for the various financial servicers in the US. New credit scores that focus more on future ability to pay are being deployed to enhance credit risk models. Therefore your high credit score might not be that special.

Many lenders may use these scores instead of the base FICO Score. You have more than one credit score. Each scoring model.

FICO scores range from 300 to 850 with 850 considered a perfect score. Your credit scores are calculated using information from your. What Are the Three Different Credit Scores.

The higher your score the more attractive you. We break down all the different credit scores and what each means to your finances. The three main credit reports are Equifax TransUnion and Experian.

And even if a credit bureau is using the same credit-scoring model you can end up with different credit scores because scores are calculated using information from different credit reports. According to Ethan Dornhelm vice president of FICO Scores and predictive analysis theres no. L2C offers an alternative credit score that uses utility payment histories to determine creditworthiness and many lenders use this score in addition to bureau scores to make lending decisions.

In fact you may have more than 30. How can there be so many variations on a single score. How many credit scores do I have.

There are two main credit scoring models used to calculate credit scores. All the information is combined together in a credit. While most of the information collected on consumers by the three credit bureaus is similar there are differences.

All FICO scores range between 350 and 850 with 850 being a perfect credit score. Other Types of. Credit scores are often three-digit numbers and the most popular scores have a range of 300 to 850.

FICO also known as the Fair Isaac Corporation is a well-known and popular scoring model. It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process. So there are two different kinds of scoring systems.

Some lenders report to all three major credit bureaus but others report to only one or two. The bureaus use credit scoring models to. This is one of the reasons you may have several different credit scores depending on where you get your information.

FICO for example has up to 50 different variations depending on the use auto loans etc. The major difference is that Canadian credit scores range from 300 points to 900 points with most people needing a minimum score of 680 to get a. VantageScore has many different variations as well.

How Many Credit Scores Do You Have

How Many Credit Scores Do You Have

What Is The Average Credit Score In America Credit Com

What Is The Average Credit Score In America Credit Com

How Many Credit Scores Do I Have Credit Score Check Credit Score Improve Your Credit Score

How Many Credit Scores Do I Have Credit Score Check Credit Score Improve Your Credit Score

Why Do I Have So Many Credit Scores Experian

Why Do I Have So Many Credit Scores Experian

Credit Scores Defined What Are Credit Scores And What Affects Them

Credit Scores Defined What Are Credit Scores And What Affects Them

How Many Types Of Credit Score By Rokdabazaar Issuu

How Many Types Of Credit Score By Rokdabazaar Issuu

You Don T Know Your Real Credit Score And Your Real Credit Score Is

You Don T Know Your Real Credit Score And Your Real Credit Score Is

What Makes A Good Credit Score And How To Improve Yours

What Makes A Good Credit Score And How To Improve Yours

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

Pop Quiz How Many Credit Scores Do You Have Most People Are Way Off Mortgage Credit Score Pop Quiz Credit Bureaus

Pop Quiz How Many Credit Scores Do You Have Most People Are Way Off Mortgage Credit Score Pop Quiz Credit Bureaus

How Many Types Of Credit Scores Are There Mybanktracker

How Many Types Of Credit Scores Are There Mybanktracker

Comprehensive Guide To An 800 Credit Score Creditloan Com

Comprehensive Guide To An 800 Credit Score Creditloan Com

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

Comments

Post a Comment