Featured

Modern Day Redlining

As such minorities are subsequently disadvantaged in their educational opportunities as a result of modern day redlining practices. We exposed modern-day redlining in 61 cities.

Modern Day Redlining In Philadelphia And The Promise Zoneshared Prosperity Shared Prosperity

The private market does not.

Modern day redlining. This story was originally published by Reveal from The Center for Investigative Reporting a nonprofit news organization based in the San Francisco Bay Area. This modern-day redlining persisted in 61 metro areas even when controlling for applicants income loan amount and neighborhood according to a mountain of Home Mortgage Disclosure Act records analyzed by Reveal from The Center for Investigative Reporting. Yes the Fair Housing Act of 1968 prohibited discrimination concerning the sale rental and financing of housing based on race religon nantional origin or sex.

These disparities hurt all Philadelphians and likely impact my constituents disproportionately the Point Breeze councilman said. Modern-Day Redlining Posted by NPLS on April 11 2018 As we celebrate 50 years of the Fair Housing Act enacted on April 11 1968 its important to remember that one of the key motivations for this groundbreaking legislation was to fight against discriminatory lending practices otherwise known as redlining. In 61 metro areas across the US people of color were more likely to be denied conventional mortgage loans than whites even when controlling for applicants income loan amount and neighborhood.

Historically communities of color have been blocked from capital and resources through redlining a practice formally dating back to the 1930s wherein loans were made incredibly expensive in. Noel Andrés Poyo. Hence why schools serve as modern day redlining.

Lets Move Our Money. The Burden on Underbanked and Excluded Communities in New York. In February 2018 Reveal published a story on the large racial differences in home lending also known as modern-day redlining across the United States.

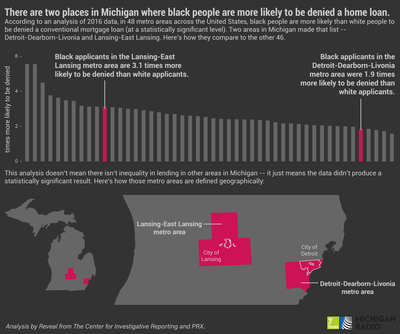

Banks Face Probes for Refusing Home Loans for People of Color. NALCAB National Association for Latino Community Asset Builders. This map of a statistical analysis by Reveal from The Center for Investigative Reporting tracks those disparities.

The loans are a form of modern-day redlining the report says a reflection of the systemic racism in the financial markets and the urban environment the report said. The private market works in white communities. By Aaron Glantz October 25 2018.

Prepared for the United States House of Representatives. Modern-day redlining today typically refers to the discrimination that people and communities of color face in accessing loans banking and mainstream financial products. Modern-day Redlining Its been over 50 years since the Fair Housing Act of 1968 was passed under President Lyndon B.

11 2017 photo provided by Reveal Rachelle Faroul right and her partner Hanako Franz sit outside their new home in Philadelphia. Subcommittee on Consumer Protection and Financial Institutions. How banks block people of color from homeownership.

Find out whats happened since. Councilman Kenyatta Johnson to introduce bill for a hearing on racial disparities in the Philadelphia home loan market. The law was meant to prohibit discrimination concerning the sale rental and financing of housing.

As real estate agents we are not allowed to steer people to certain neighborhoods and yet services like Redfin embed GreatSchools information right into home listings inevitably steering people into certain neighborhoods based on school ratings. How banks block people of color from homeownership. Sarah Blesener for Reveal Pennsylvania Attorney General Josh Shapiro launched a fresh push in his investigation of modern-day redlining Tuesday calling on home loan applicants in Philadelphia to file complaints with his office if they believe they have faced discrimination or experienced irregularities when trying to take out a mortgage.

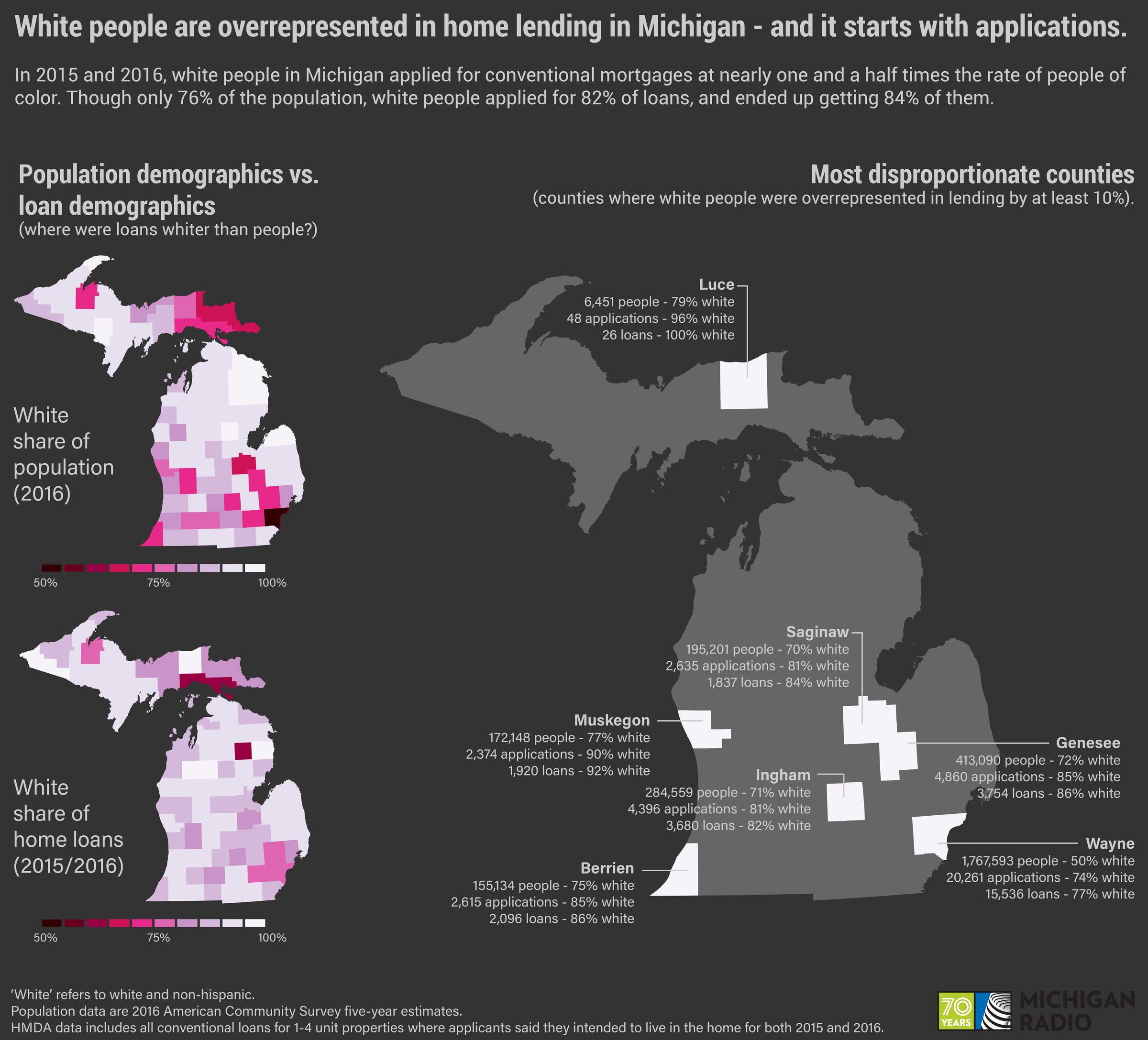

Reveal did a national analysis of lending patterns using conventional mortgage records in 2015 and 2016. Lawmaker Demands Action Against Banks Practicing Racist Redlining.

Redlining Was Banned 50 Years Ago It S Still Hurting Minorities Today The Washington Post

Redlining Was Banned 50 Years Ago It S Still Hurting Minorities Today The Washington Post

Modern Day Redlining Banks Discriminate In Lending

Modern Day Redlining Banks Discriminate In Lending

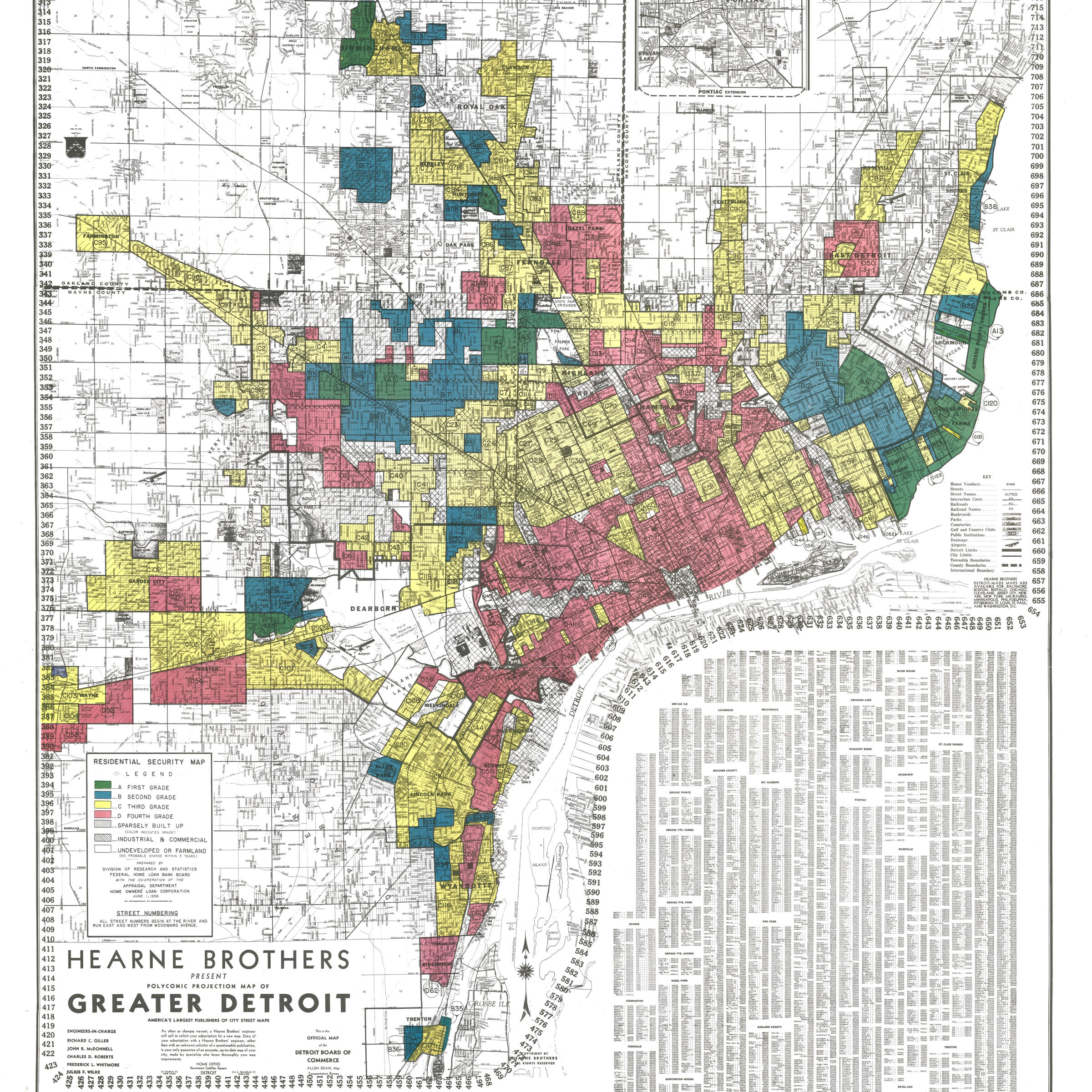

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

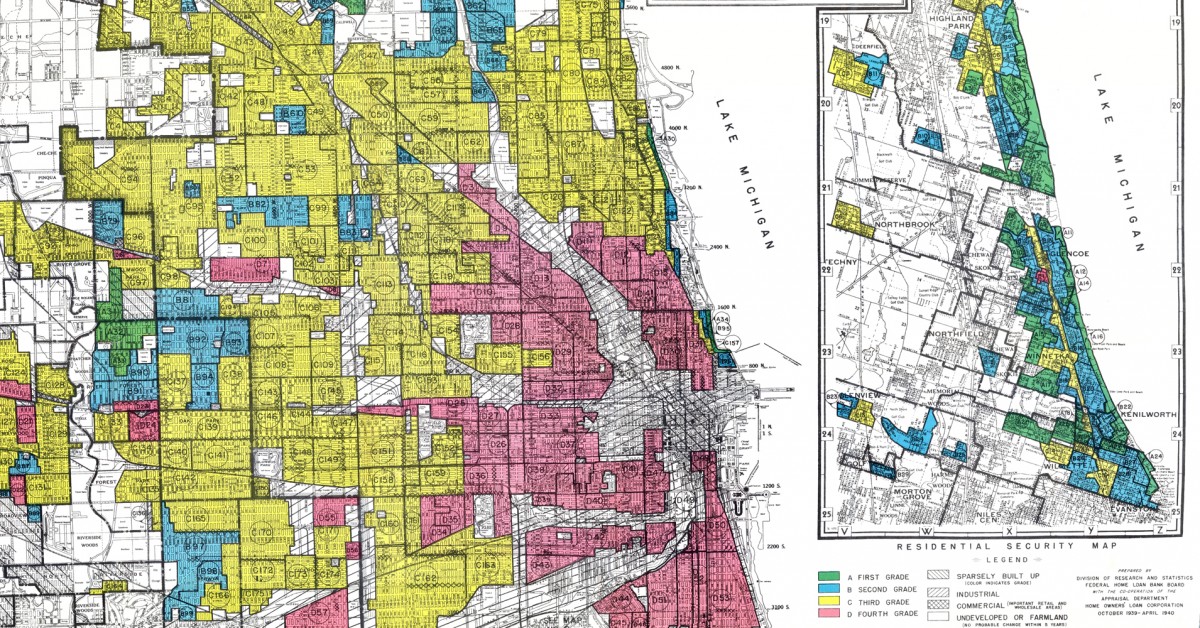

Modern Day Redlining How Banks Block People Of Color From Homeownership Chicago Tribune

Geographies Of Racial Justice In Chicago Webinar Series Modern Day Redlining Gentrification And The Legacy Of Segregation In Chicago The Geographic Society Of Chicago

Geographies Of Racial Justice In Chicago Webinar Series Modern Day Redlining Gentrification And The Legacy Of Segregation In Chicago The Geographic Society Of Chicago

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

Modern Redlining How Banks Keep People Of Color From Buying Homes 88 5 Wfdd

Modern Redlining How Banks Keep People Of Color From Buying Homes 88 5 Wfdd

Inequality In America Modern Day Redlining In Chicago Creates Home Loan Inequality

Inequality In America Modern Day Redlining In Chicago Creates Home Loan Inequality

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

Data Analysis Modern Day Redlining Happening In Detroit And Lansing Michigan Radio

An Epidemic Of Modern Day Redlining Wunc

An Epidemic Of Modern Day Redlining Wunc

Modern Day Redlining North Penn Legal Services

Modern Day Redlining North Penn Legal Services

Housing In Brief Modern Day Redlining Next City

Housing In Brief Modern Day Redlining Next City

Modern Day Redlining How Banks Block People Of Color From Homeownership Chicago Tribune

Modern Day Redlining How Banks Block People Of Color From Homeownership Chicago Tribune

Comments

Post a Comment