Featured

Mutual Funds And Etfs

11 Nasdaq-100 ETFs and Mutual Funds to Buy The QQQ is the best-known ETF that invests in the popular Nasdaq-100 Index. ETFs are subject to market fluctuation and the risks of their underlying investments.

Etf Vs Mutual Fund Everything You Need To Know Personal Fi Guy

Etf Vs Mutual Fund Everything You Need To Know Personal Fi Guy

Mutual Funds ETFs.

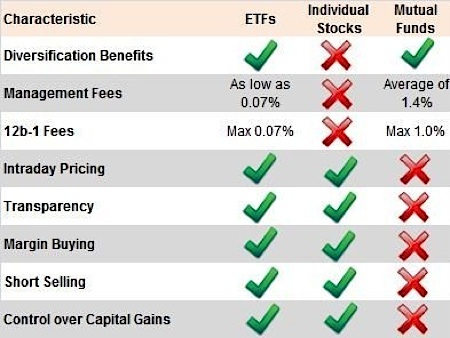

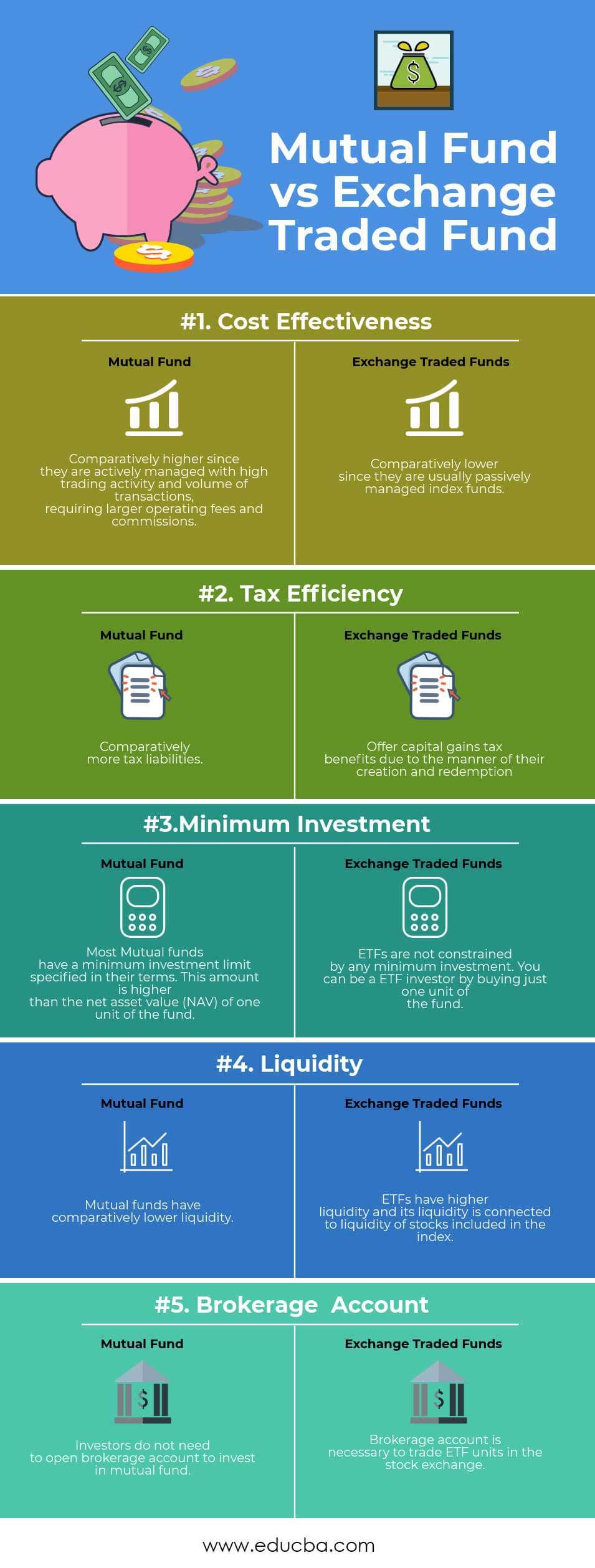

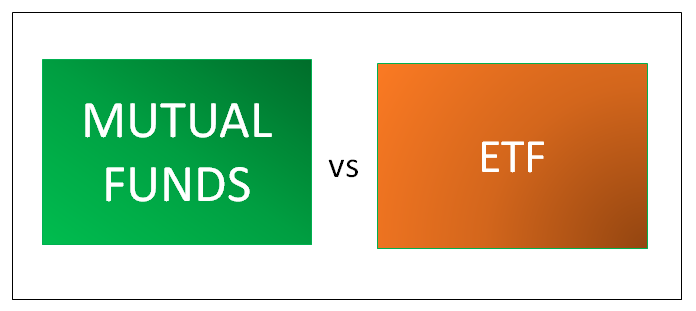

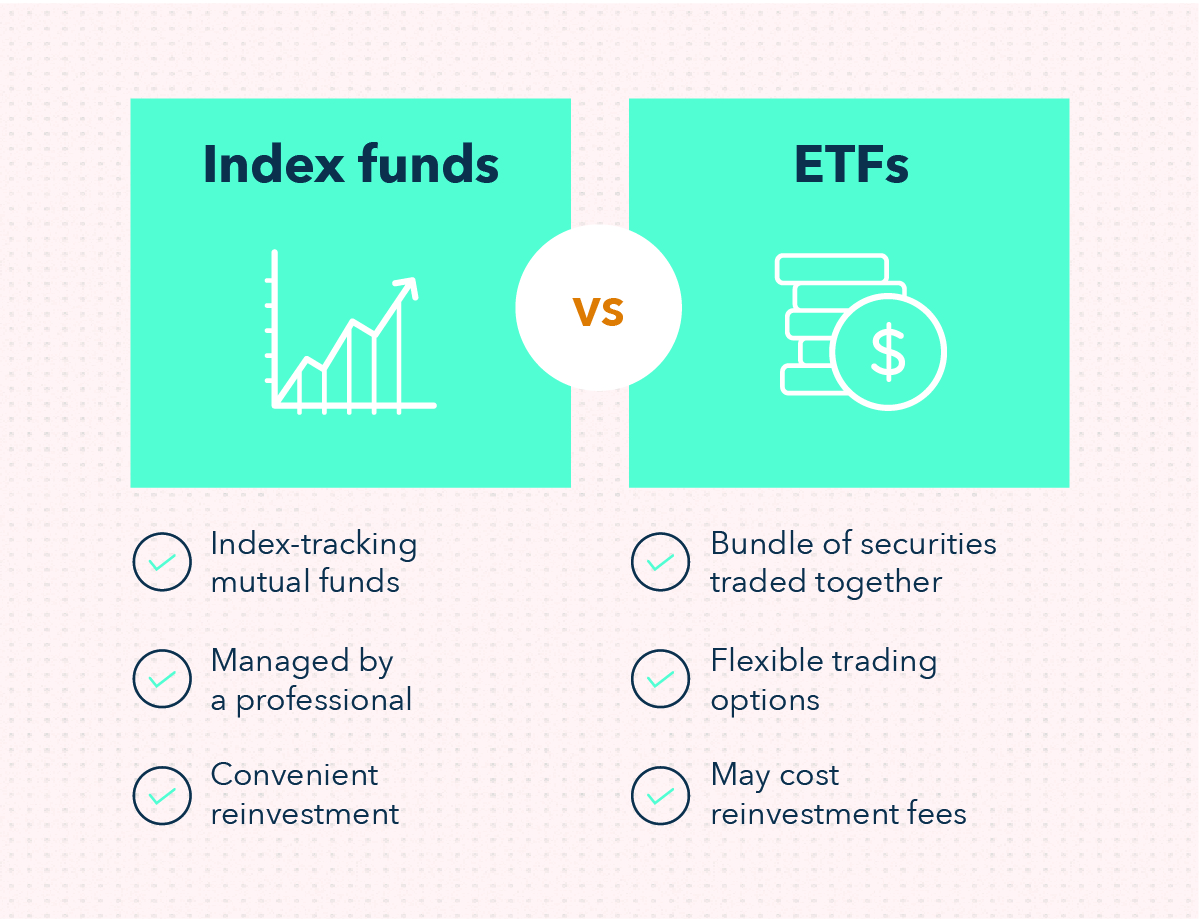

Mutual funds and etfs. Most mutual funds are actively managed which means a human makes investment decisions and tries to outperform a market index. Similarities between ETFs mutual funds The biggest similarity between ETFs exchange-traded funds and mutual funds is that they both represent professionally managed collections or baskets of individual stocks or bonds. Investment assets but ETFs are gaining market share as it appears that people who are more comfortable making.

Here are some of this years best ETFs. However actively managed and indexed mutual funds are available as either traditional mutual funds or as ETFs. Mutual Funds and ETFs A Guide for Investors.

But the vast majority. Unlike mutual funds ETF shares are bought and sold at market price which may be higher or lower than their NAV and are not individually redeemed from the fund. 1 Investor Shares A traditional mutual fund with an expense ratio of 017 and a 3000 minimum to invest.

Both mutual funds and ETFs hold portfolios of stocks andor bonds and occasionally something more exotic such as precious metals or commodities. ETFs exchange-traded funds and mutual funds both offer exposure to a wide variety of asset classes and niche markets. Mutual funds similar to ETFs can provide exposure to an entire sector but are priced at the end of the trading day based on its net asset value.

ETFs exchange-traded funds and mutual funds offer cost-efficient ways to diversify but they differ in how theyre taxed traded and managed. But as with other investment choices investing in mutual funds and ETFs involves risk. Best Fidelity Mutual Funds.

They generally provide more diversification than a single stock or bond and they can be used to create a diversified portfolio when funds from multiple asset classes are combined. For example there are three share classes of the Vanguard Total Stock Market Index Fund. ETFs are subject to management fees and other expenses.

Mutual funds continue to hold most of the US. Mutual funds and ETFs can offer the advantages of diversification and professional management. ETFs are more tax efficient and investors can buy just one share.

Both can track indexes as well however ETFs tend. All of the mutual fund and ETF information contained in this display with the exception of the current price and price history was supplied by Lipper A Refinitiv Company. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free.

But several other funds are at your disposal too. Break down the definition of an. Exchange-traded funds are easy and affordable ways to invest.

This brochure explains the basics of mutual fund and ETF. In addition fees and taxes can diminish a funds returns. 6 rows ETFs are usually more tax-efficient than mutual funds because ETF shares are traded on an.

Etfs Vs Mutual Funds The Age Old Question Wisdomtree

Etfs Vs Mutual Funds The Age Old Question Wisdomtree

Mutual Fund Or Etf Which Is Right For You Snap

Mutual Fund Or Etf Which Is Right For You Snap

Mutual Funds Can Be Better Than Etfs At Times Etf Com

Mutual Funds Can Be Better Than Etfs At Times Etf Com

Mutual Fund Demand Has Hit A Wall As Sales Of Etfs Surge Financial Pipeline

Mutual Fund Demand Has Hit A Wall As Sales Of Etfs Surge Financial Pipeline

Mutual Fund Vs Exchange Traded Fund Which One Is Better

Mutual Fund Vs Exchange Traded Fund Which One Is Better

Stocks Vs Etfs Vs Mutual Funds Fidelity

Stocks Vs Etfs Vs Mutual Funds Fidelity

The Difference Between Mutual Funds And Etfs Wealth 101

The Difference Between Mutual Funds And Etfs Wealth 101

7 Differences Between Mutual Funds And Etfs U S Global Investors

What You Need To Know About Mutual Funds Etf S Schenley Capital

What You Need To Know About Mutual Funds Etf S Schenley Capital

Mutual Funds Vs Etfs Presidio Wealth Management

Mutual Funds Vs Etfs Presidio Wealth Management

Key Considerations Comparing Mutual Funds And Etfs Ultimus

Key Considerations Comparing Mutual Funds And Etfs Ultimus

Etf Vs Index Funds What Is The Difference Mint

Etf Vs Index Funds What Is The Difference Mint

Etf Vs Mutual Fund What S The Difference Ally

Etf Vs Mutual Fund What S The Difference Ally

Comments

Post a Comment