Featured

What Are Commodity Futures

Commodity trading with futures contracts takes place at a futures exchange and like the stock market is entirely anonymous. Commodity futures are agreements of contracts that are utilized to purchase or sell a specified amount of a given commodity.

While a commodity is a good that gets traded a futures contract is a mechanism for carrying out such trades.

What are commodity futures. Commodities can broadly be categorised as food energy and metals. A commodity futures contract is a binding legal obligation to buy or sell the underlying commodity in stipulated quantities at a predetermined price on the expiry date in the future. Commodity Futures and Options Access the widest range of global futures and options at CME Group in the worlds most liquid markets.

A commodity futures contract allows an investor to trade a certain quantity of the commodity of their choice at a specific price at a later point in time. The latest commodity trading prices for oil natural gas gold silver wheat corn and more on the US. A commodity futures contract is a type of derivative whereby investors enter into an agreement to buy or sell a fixed amount of a commodity at a predetermined price on a predetermined date.

A commodity market is a market that trades in the primary economic sector rather than manufactured products. Futures are standardized contracts among buyers and sellers of commodities that specify the amount of a commodity gradequality and delivery location. Agriculture Energy and Metals.

Commodities futures market. Trade all major commodities. The CME Group sold the foregoing products and exercised its monopoly power so as to enable the HFTs to achieve gains.

For example the buyer might be an end-user like Kelloggs. Disclosed in its SEC Form S-1 filed. Unlike the stock markets commodity futures and option trading are zero sum games That is the market actually has an offsetting loss for every gain in each commodity futures contract.

They set those prices. Futures are agreements to buy or sell a quantity of something at a set price on a. For example HFT firm Virtu Financial Inc.

The agreement will commit the buyer and the seller to a fixed price that will be in effect on a specified future date. A commodity futures is a standardized contract that obliges the buyer to purchase some underlying commodity or the seller to sell it at a predetermined future price and date. Futures contracts are the oldest way of investing in commodities.

Commodities can broadly be categorised as food energy and metals. Get all the latest updates on the commodity market gold rate silver crude oil and stay ahead any time anywhere only on Moneycontrol. Futures are a legal obligation in which someone agrees to buy or sell a commodity on a specific date at a specific price.

A commodity futures contract is a type of derivative whereby investors enter into an agreement to buy or sell a fixed amount of a commodity at a predetermined price on a predetermined date. Commodity futures are buysell contracts of commodities fixed at todays price but realized on a future date. Know in detail about commodity futures at Angel Broking start trading now.

Soft commodities are agricultural products such as Wheat coffee sugar and cocoa. Hard commodities are mined products such as gold and oil. Commodity futures are agreements to buy or sell oil food or other raw materials at a future date at a particular price.

Commodity futures are agreements to buy or sell a particular commodity at a predetermined price in the future.

Difference Between Commodity Futures Spot Commodity Market 5paisa School

Difference Between Commodity Futures Spot Commodity Market 5paisa School

Example Of Commodity Futures Contract Download Scientific Diagram

Example Of Commodity Futures Contract Download Scientific Diagram

Commodity Futures Meaning Objectives Of Commodity Markets Ppt Video Online Download

Commodity Futures Meaning Objectives Of Commodity Markets Ppt Video Online Download

Commodity Futures Market And Its Mechanisms

Commodity Futures Market And Its Mechanisms

Commodity Futures By Futurestradingpedia Com

Introduction Of Commodity Futures Markets By Andrew Clarke Issuu

Introduction Of Commodity Futures Markets By Andrew Clarke Issuu

Commodity Futures Trading Strategies Ppt Powerpoint Presentation File Background Image Cpb Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Commodity Futures Trading Strategies Ppt Powerpoint Presentation File Background Image Cpb Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Commodity Futures Trading Commission Wikipedia

Commodity Futures Trading Commission Wikipedia

Commodity Futures Trading Cycle Tutorials

Commodity Futures Trading Cycle Tutorials

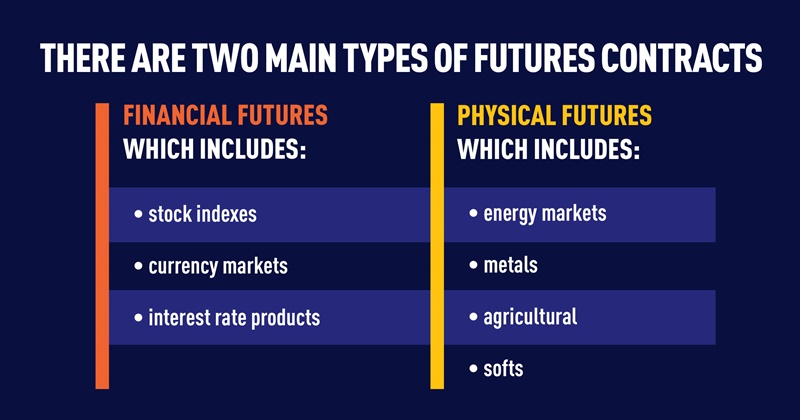

Common Types Of Futures Contracts Online Trading Academy

Common Types Of Futures Contracts Online Trading Academy

What Are Commodity Futures Contracts Basics Of Futures Trading Paxforex

What Are Commodity Futures Contracts Basics Of Futures Trading Paxforex

Commodity Futures Service कम ड ट ज फ य चर स ट र ड ग कम ड ट ज फ य चर ट र ड ग In Modern Colony Jalandhar Fairdeal Securities Id 5766697333

Commodity Futures Service कम ड ट ज फ य चर स ट र ड ग कम ड ट ज फ य चर ट र ड ग In Modern Colony Jalandhar Fairdeal Securities Id 5766697333

Comments

Post a Comment