Featured

Helper Act Student Loans

Perhaps the most prominent feature of the HELPER Act is the option for student loan borrowers to withdraw up to 5250 annually from a 401k plan or IRA tax- and penalty-free to either pay for. Ed Kerestly the Financial Aid Director at Angelo State University spoke to our Sidney Timmer about how this bill could help or hurt you.

Opinion Helper Act Would Make College Tax Deductible

Opinion Helper Act Would Make College Tax Deductible

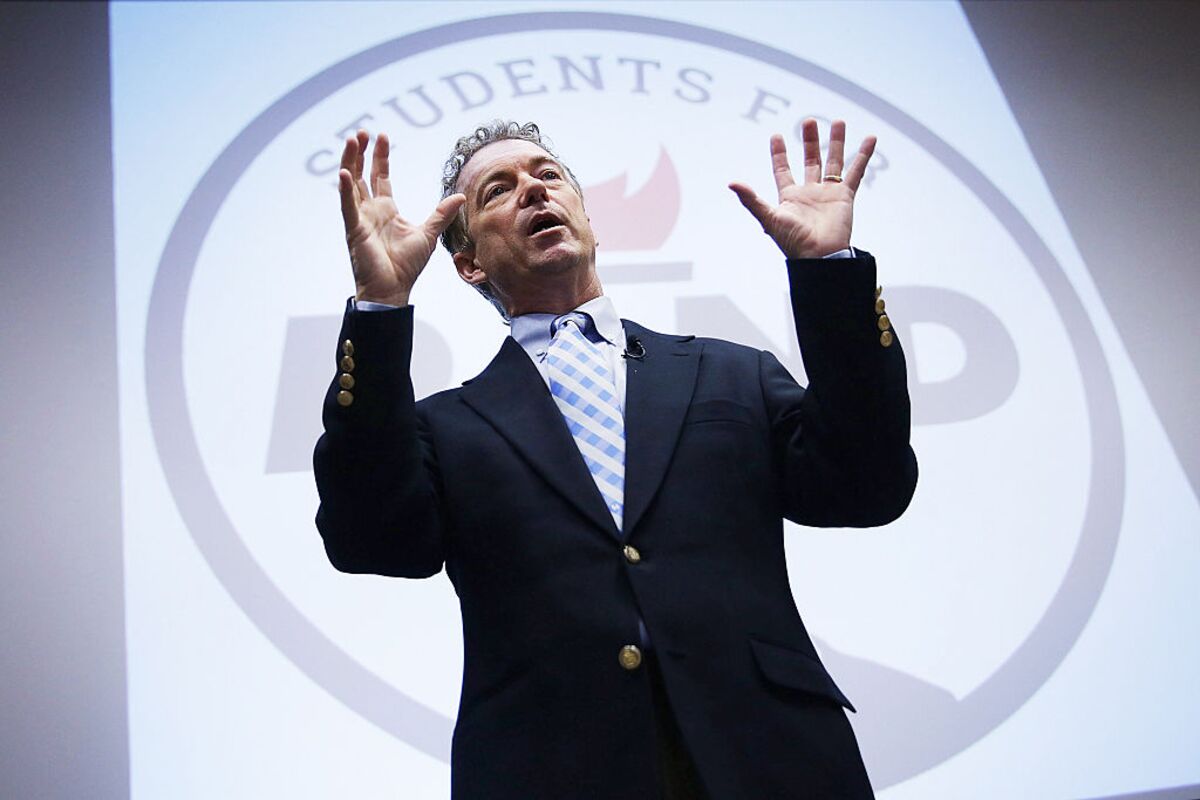

The Republican senator from Kentucky last week unveiled the Higher Education Loan Repayment and Enhanced Retirement Act or Helper Most notably it would allow individuals to withdraw up to.

Helper act student loans. In response to these concerns and to ensure that students would still be able to access higher education Congress passed the Ensuring Continued Access to Student Loans Act ECASLA authorizing ED to temporarily begin the purchasing of FFELP loans from lenders so those lenders could continue the financing of future loans. The HELPER Act is a bill to let people withdraw up to 5250 annually from their retirement accounts tax and penalty-free to reduce college loans. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

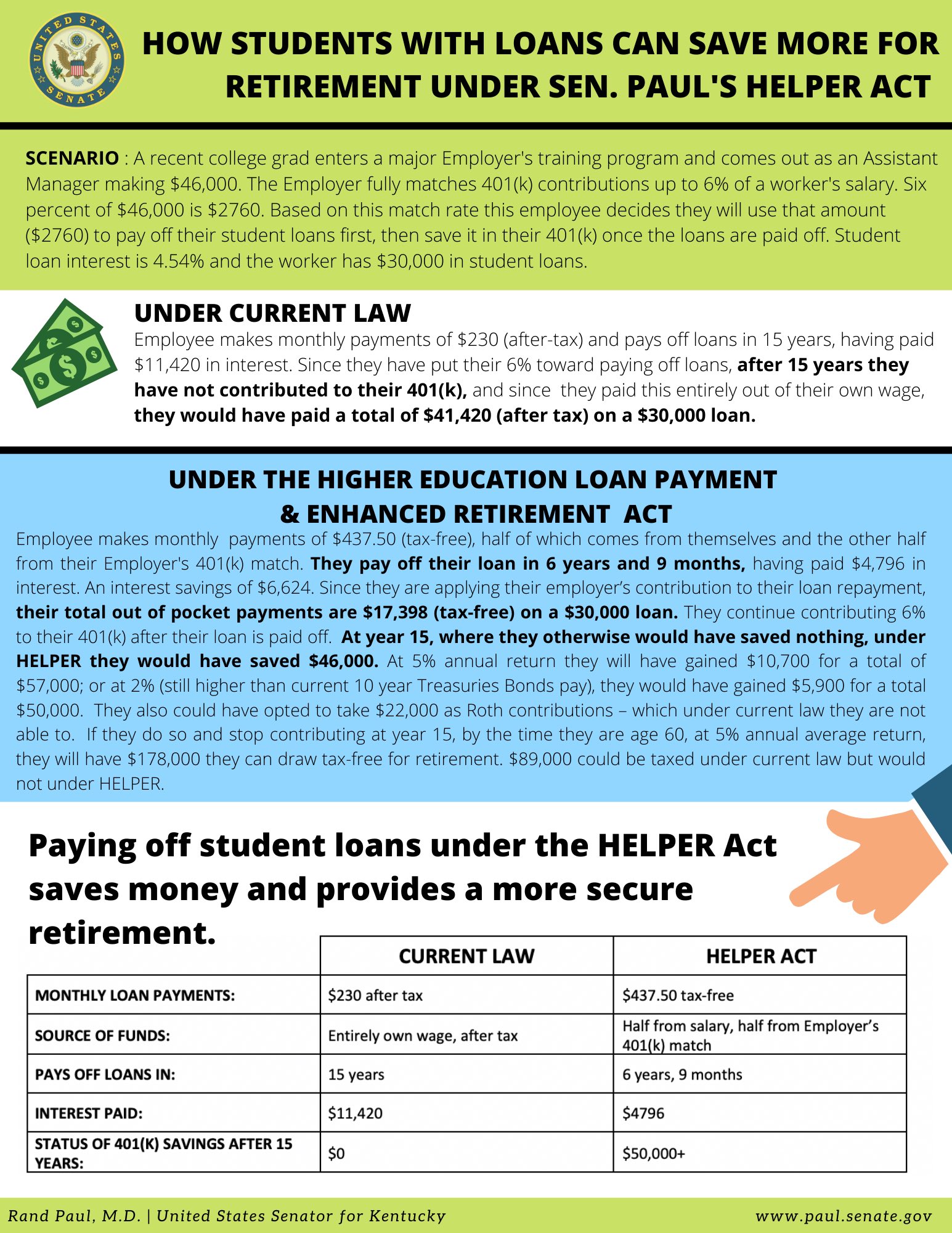

Paul said we think it would dramatically. This means if you filled out the FAFSA and borrowed loans as a result your loans might be affected. The HELPER Act allows individuals to take up to 5250 per year from a 401 k or individual retirement account without paying a tax or penalty.

They can put the funds toward the cost of college or to pay back student loans. The Coronavirus Aid Relief and Economic Security CARES Act passed Congress last week to address many of the issues created by the coronavirus. The Higher Education Loan Payment and Enhanced Retirement HELPER Act S.

The CARES Act has two big impacts on federally held student loans. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. Department of Education between March 13.

2962 will also expand the student loan interest deduction and exclude up to 5250 in employer-paid student loan repayment assistance programs LRAPs from the employees income. Advertentie MPOWER provides financing for international students studying in the US. Rutherford co-sponsors HELPER Act loan program.

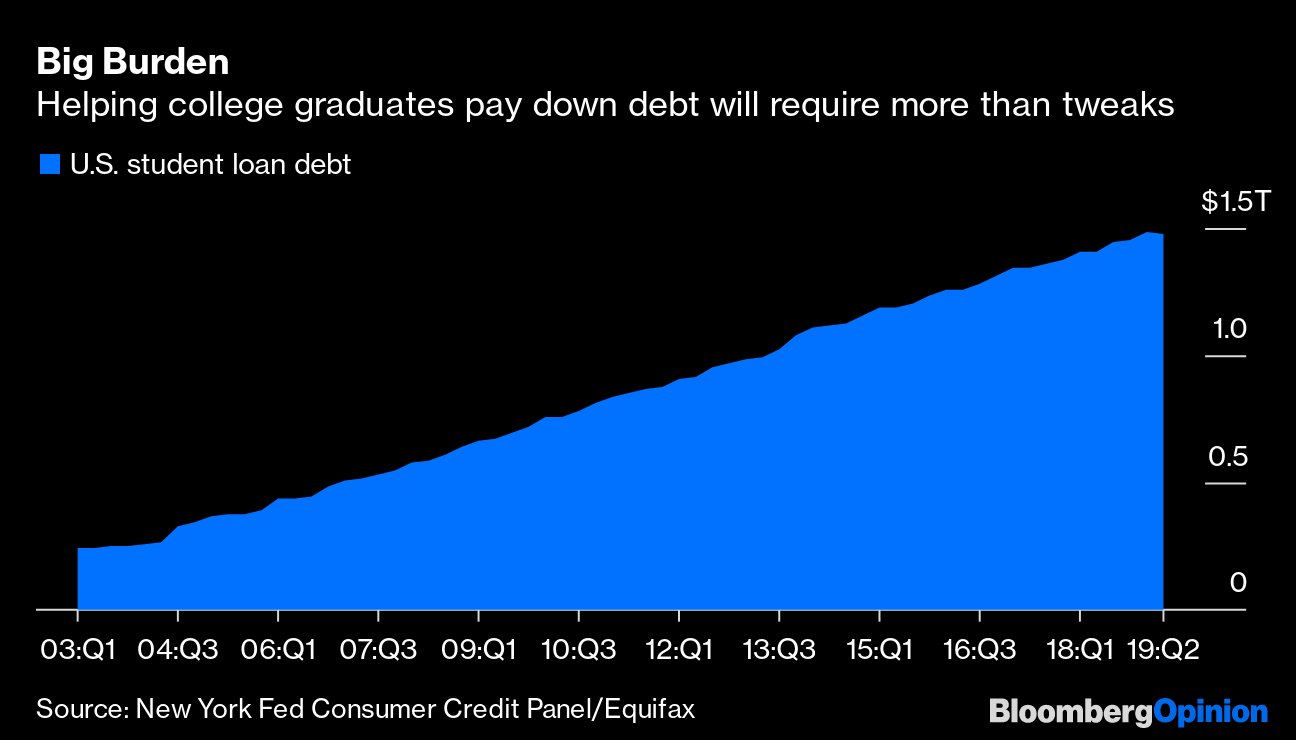

The HEROES Act would give you 10000 of student loan forgiveness. Pauls HELPER Act would allow Americans to annually take up to 5250 from a 401k or IRA tax and penalty free to pay for college or pay back student loans. Student loan debt hits its highest-ever levels Dr.

Currently withdrawing from a 401 k or IRA before retirement age incurs a tax penalty. President Trump quickly signed the bill into law. What the CARES Act Does for Federal Student Loans.

Advertentie MPOWER provides financing for international students studying in the US. This is similar to proposal from Senate Democrats that would provide 10000 of student loan forgiveness but much smaller than a. The CARES Act allows employers to pay up to 5250 toward student loans on behalf of employees and the employees would not owe US.

But a big question is whether many would even consider doing so. These funds could also be used to pay tuition and expenses for a spouse or dependent. Federal income taxes on the payments.

Congress is unlikely to consider the HELPER Act this year. Employers can pay down their workers student loans by more than 5000 this year tax free under a provision in the Cares Act. The first thing that the CARES Act does is set interest on student loans to 0 through September 30 2020.

By News Staff on Wednesday May 19 2021 John Rutherford. John Rutherford R-Fla and three other members of Congress have introduced the Homes for Every Local Protector Educator and Responder HELPER Act. Under the new law no payments are required on federal student loans owned by the US.

David Pakman On Twitter Lol Lots Of The People With Student Loans Don T Have 401k S Nor Ira S Because All That Money Has Been Going To The Student Loans

David Pakman On Twitter Lol Lots Of The People With Student Loans Don T Have 401k S Nor Ira S Because All That Money Has Been Going To The Student Loans

Get Free Money For Student Loans 5250 Employer Student Loan Assistance Program Cares Act 2020 Youtube

Get Free Money For Student Loans 5250 Employer Student Loan Assistance Program Cares Act 2020 Youtube

Senator Rand Paul On Twitter Paying Off Student Loans Under My Plan The Helper Act Saves Money And Helps Provide For A More Secure Retirement Check Out This Example To See How

Senator Rand Paul On Twitter Paying Off Student Loans Under My Plan The Helper Act Saves Money And Helps Provide For A More Secure Retirement Check Out This Example To See How

.png) How New Student Loan Legislation Will Ease Financial Burden On Retirees Employee Benefit News

How New Student Loan Legislation Will Ease Financial Burden On Retirees Employee Benefit News

What To Know About Rand Paul S Helper Act For Student Loan Repayment

What To Know About Rand Paul S Helper Act For Student Loan Repayment

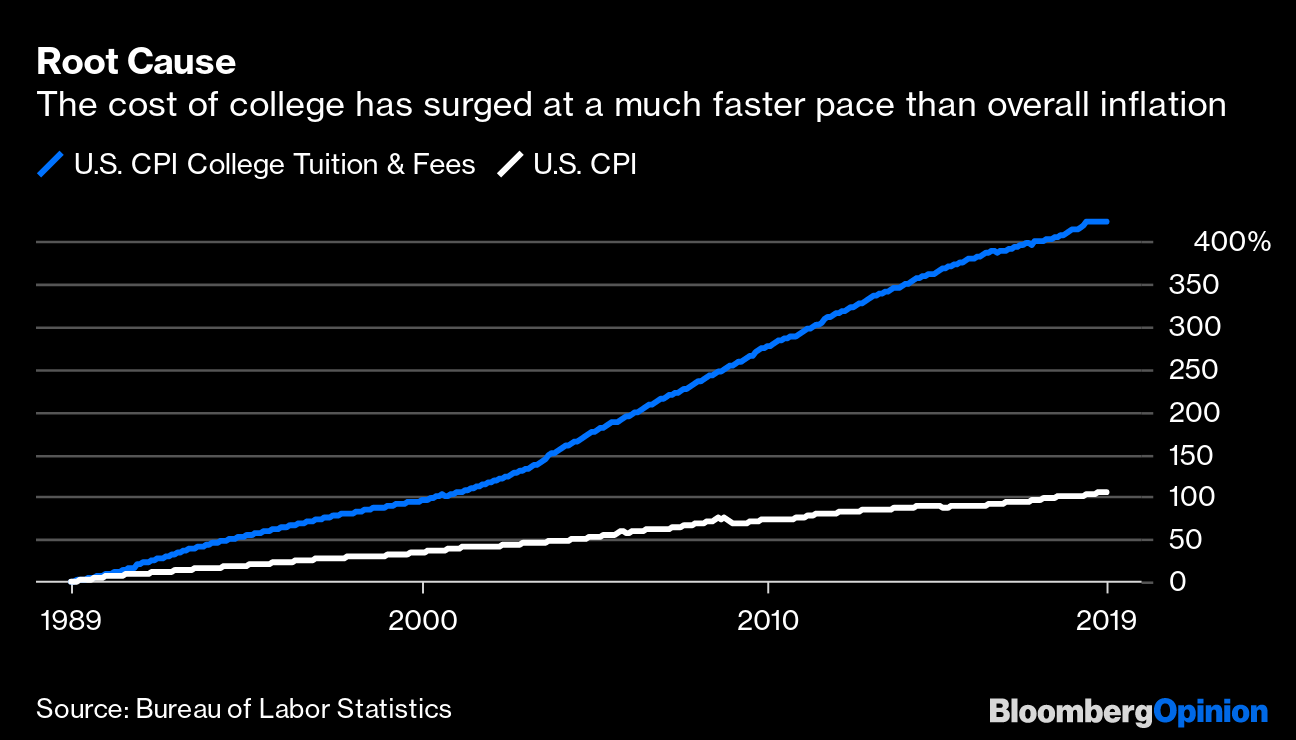

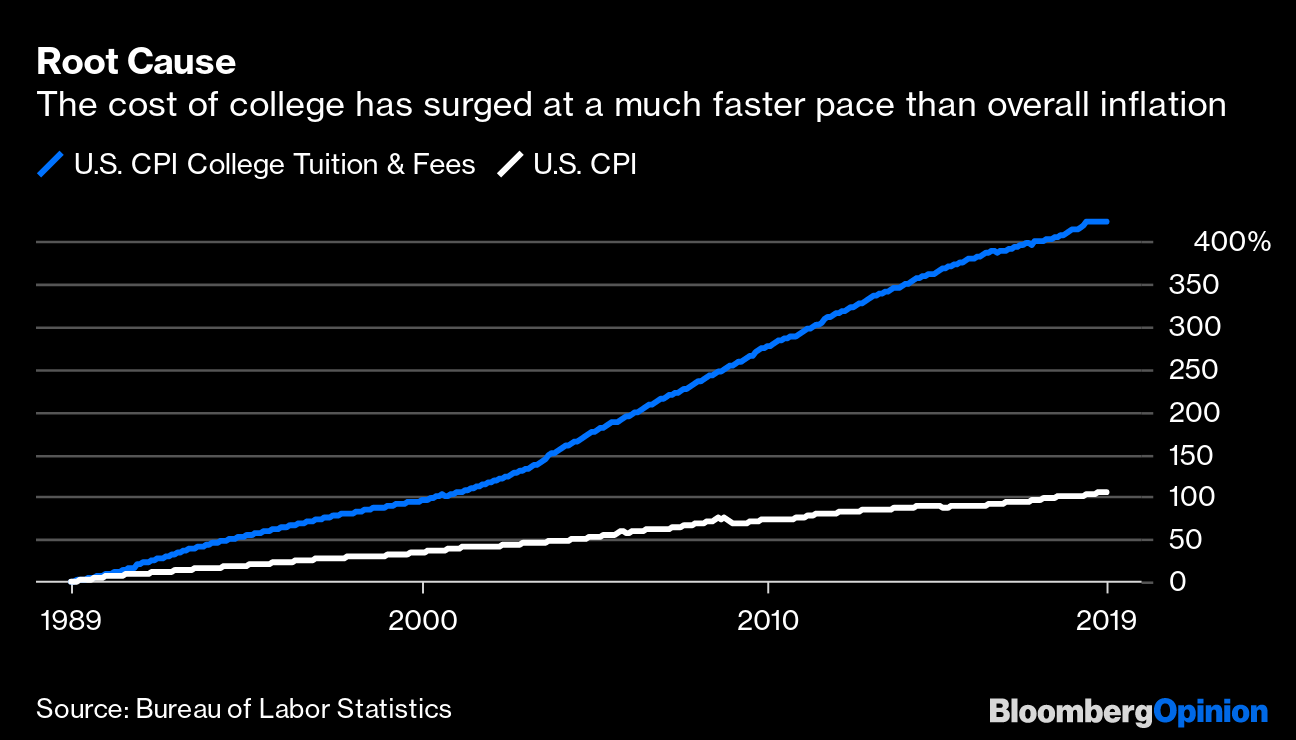

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Dr Rand Paul Introduces Helper Act To Reduce Student Loan Debt And Increase Retirement Savings Senator Rand Paul

Dr Rand Paul Introduces Helper Act To Reduce Student Loan Debt And Increase Retirement Savings Senator Rand Paul

How Rand Paul S Helper Act Could Affect Student Loan Debt Myfoxzone Com

How Rand Paul S Helper Act Could Affect Student Loan Debt Myfoxzone Com

Student Loan Forgiveness The Guide To 80 Programs

Student Loan Forgiveness The Guide To 80 Programs

This New Bill Could Be A Lifeline For Student Loan Borrowers The Motley Fool

This New Bill Could Be A Lifeline For Student Loan Borrowers The Motley Fool

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Rand Paul Helper Act Proposal On Student Loan Debt Falls Short Bloomberg

Comments

Post a Comment